Flipkart Axis Bank Credit Card Review: Earn Unlimited Cashback

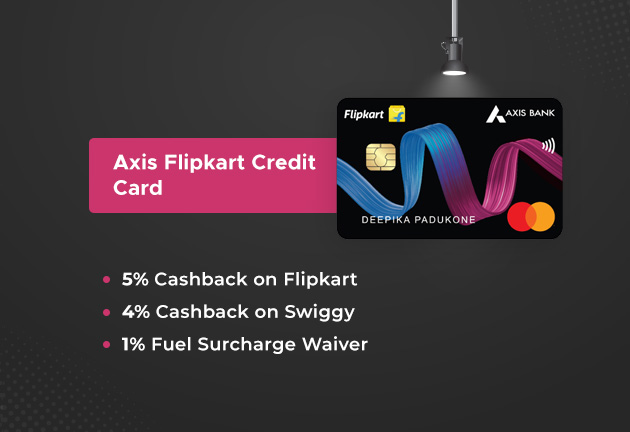

Flipkart Axis Bank Credit Card offers impressive cashback benefits, making it an appealing choice for frequent online shoppers. This credit card is particularly advantageous for those who regularly purchase from Flipkart and preferred partners like Swiggy, Uber, and Cleartrip.

Key Features

The Flipkart Axis Bank Credit Card packs several attractive features:

Cashback Benefits

Enjoy unparalleled cashback rates across different spending categories:

| Spending Category | Cashback Rate |

|---|---|

| Flipkart purchases | 5% |

| Partner Merchants (Swiggy, Uber, Cleartrip, etc.) | 4% |

| All other online and offline spends | 1% |

For more cashback-focused options, you might want to explore the SBI Cashback Credit Card Review or check out the benefits of the Axis Neo Credit Card.

Exclusions

Beware of these exclusions, as cashback is not applicable:

- Fuel spends

- Rental payments

- Insurance and utility payments

- Education payments

- Gift card purchases

- EMI conversions

- Wallet reloads

- Gold purchases

- Cash advances

- Credit card fee payments

- Government services

Welcome Benefits

Upon activating this card, you can enjoy welcome benefits worth ₹600, which include:

If you’re into cards that offer strong dining and entertainment benefits, the Axis Bank My Zone Credit Card Review might also interest you.

Travel Benefits

For comparison, the Axis Magnus Card Review offers additional travel perks if you’re looking for more premium features.

Comparison with Other Cards

| Features | Flipkart Axis Bank Credit Card | Amazon Pay ICICI Credit Card | SBI Cashback Credit Card |

|---|---|---|---|

| Reward Structure | Cashback adjusted against statement balance | Cashback added to Amazon Pay balance | Cashback adjusted against statement balance |

| Rewards Rate (Partners) | 5% on Flipkart, 4% on partners | 5% (Prime), 3% (non-Prime) | 5% on all online spends |

| Rewards Rate (Other Spends) | 1% | 1% | 1% |

| Max Cashback Cap | No Cap | No Cap | ₹5000 Monthly |

| Additional Benefits | 4 complimentary domestic lounges, 15% dining discount | Up to 20% off at partner restaurants | N/A |

| Membership Fee | ₹500 + GST | Lifetime Free | ₹999 + GST |

For another strong competitor, the Amazon Pay ICICI Credit Card might catch your eye, particularly for Amazon shoppers.

Application and Eligibility

Applying for the Flipkart Axis Bank Credit Card is straightforward, and it requires specific eligibility criteria:

- Minimum monthly income: ₹15,000 for salaried individuals, ₹30,000 for self-employed

Follow these steps to apply:

- Click “Apply Now” on the Bank’s website

- Fill in your details and upload required documents

- Submit your application

You can track your application status on the Axis Bank website using your Application ID or mobile number/PAN.

Latest Updates

From 20th April 2024, only Flipkart and preferred merchant transactions, as well as excluded categories, will earn 1% cashback. Spending ₹50,000 in the previous three months is required for airport lounge access benefits from 1st May 2024 onwards.

For cards with fuel benefits, the Axis Indian Oil Credit Card Review might be a better fit.

TataPlay will no longer be a preferred merchant from 15th February 2024. After this date, you will earn only 1% cashback on TataPlay transactions.

The reintroduction of an annual fee of ₹500 for the Flipkart Axis Bank Credit Card.

Conclusion

If you are an avid online shopper, particularly on Flipkart, the Flipkart Axis Bank Credit Card is a solid choice. The 5% cashback on Flipkart purchases and 4% on select partners offer significant savings. However, the new spend criteria for lounge access and changes in cashback rates may affect overall value for some users.

We would love to hear your thoughts about this credit card. Which one would you pick between this and the Amazon Pay ICICI Bank Credit Card? Share your thoughts in the comments below!

For alternatives to consider, you can also explore the IDFC First WOW Credit Card Review or the AU Altura Credit Card Review.

FAQs

- There is no limit to the cashback you can earn monthly with this credit card.

- The card offers 4 domestic lounge accesses annually but no international access. Spend criteria apply.

- Get 4% cashback on partner merchants like Swiggy, Uber, PVR, and Cult.fit.

- No cashback on fuel transactions. However, a 1% fuel surcharge is waived for eligible transactions.

- The annual fee is ₹500 + GST.