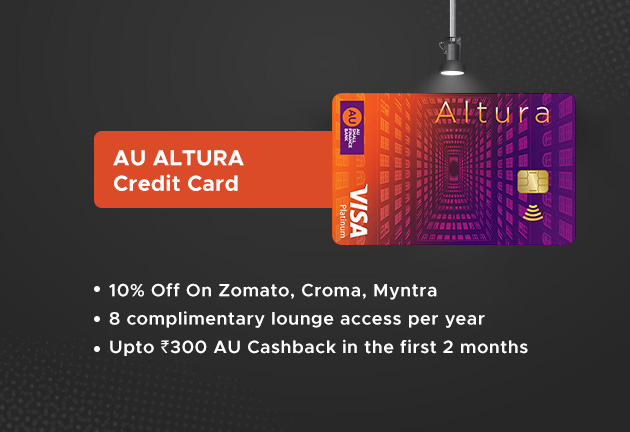

AU Altura Credit Card Review – Features, Fees & Benefits

The AU Altura Credit Card is an excellent choice for those looking to benefit from generous cashback offers on shopping alongside complimentary lounge access and other perks. If versatility across multiple categories is what you’re after, this card is definitely worth considering.

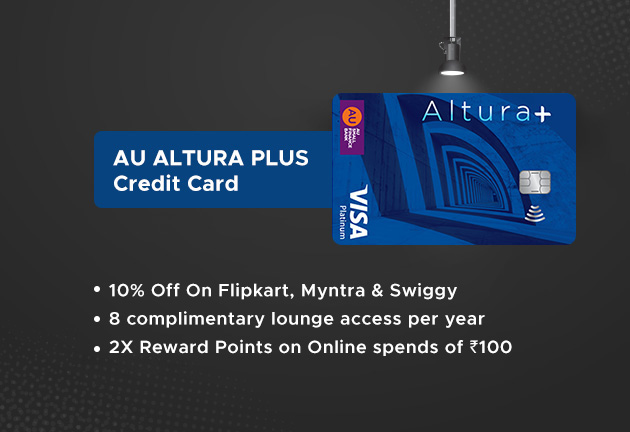

Key Features of AU Altura Credit Card

The AU Altura Credit Card offers a plethora of features designed to cater to travel and shopping enthusiasts. Here are some of the key highlights:

| Feature | Description |

|---|---|

| Welcome Benefit | 5% Cashback on minimum Rs. 2,500 retail spends made within the first 60 days of card setup |

| Milestone Benefit | Additional cashback of Rs. 50 on completing a minimum of Rs. 10,000 in retail spends per statement cycle |

| Cashback | 2% Cashback on groceries, departmental store purchases, and utility bill payments; 1% Cashback on other retail spends |

| Lounge Access | 2 complimentary lounge accesses per calendar quarter at specific railway stations |

| Fuel Surcharge Waiver | 1% waiver on fuel transactions between Rs. 400 and Rs. 5,000 |

| Contactless Payments | Payments up to Rs. 5,000 can be made without entering a PIN |

| Card Liability Cover | Zero liability on fraudulent transactions post-reporting |

| Xpress EMI | Convert transactions of Rs. 2,000 or more into EMIs |

Looking for an Axis Magnus Card? You can check the review of the Axis Magnus Credit Card to compare the benefits.

PARTNER DISCOUNTS

- 10% Instant Discount (Upto Rs 1,000) on Flipkart Orders Above Rs 10,000

- Additional 10% Off (Upto Rs 1000) on a minimum purchase of Rs 3999 on selected styles on Myntra

- 15% instant discount (Upto Rs 300 per month) on Tata CLiQ Orders Above Rs 500

- 10% off on Groceries (Upto Rs 100) on Blinkit app orders above Rs 499

- 10% off on Swiggy Instamart (Upto Rs 100 per month) on Orders Above Rs 500

For more cashback benefits, you might also be interested in the SBI Cashback Credit Card Review.

Fees and Charges

This card comes with straightforward fees and charges:

| Type | Amount |

|---|---|

| Joining Fee | Rs. 199 + Applicable Taxes |

| Annual Fee | Rs. 199 + Applicable Taxes |

| Late Payment Fees | Ranges from Nil to Rs. 1,100 depending on the outstanding amount |

If you’re looking for a card with more premium features, you can also review the ICICI Emeralde Credit Card.

Eligibility and Documentation

To apply for the AU Altura Credit Card, you must meet the following criteria:

- Indian resident aged between 21-60 years

- For add-on cardholders, the minimum age is 18 years

Documents required for application:

- Proof of Identity: PAN Card, Aadhaar card, Driver’s License, Passport, Voter’s ID, etc.

- Proof of Address: Aadhaar card, Driver’s License, Utility Bill, Ration Card, etc.

- Proof of Income: Recent salary slip, Form 16, or bank statement

How to Apply?

Applying for an AU Altura Credit Card is simple. Visit the nearest bank branch to submit your application. For further assistance, you can contact the bank’s toll-free number at 1800 1200 1200.

If you’re also interested in other credit card options, check out the IDFC First WOW Credit Card Review.

Is the AU Altura Credit Card Right for You?

This card is particularly beneficial for:

- Frequent travelers who can take advantage of railway lounge access

- Shoppers who prefer earning cashback on a variety of purchases

With its range of features and benefits, the AU Altura Credit Card is a versatile choice for anyone looking to maximize their spending power while enjoying several perks. So, if you align with the eligibility criteria and find the features appealing, this card might just be the one for you!

For additional insights, you may also want to read our detailed review on the Tata Neu HDFC Bank Credit Card.