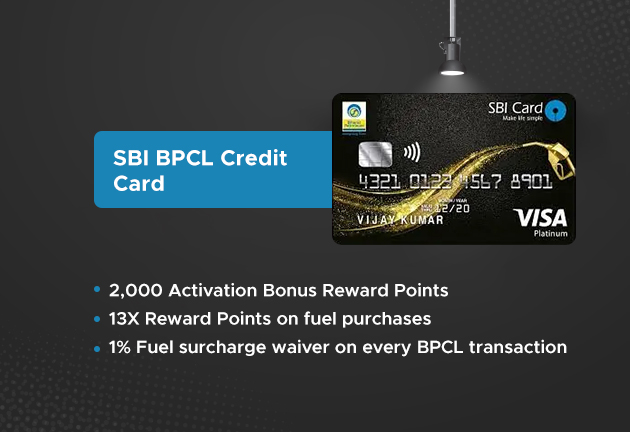

SBI BPCL Credit Card Review: Features, Benefits, Fees & More

SBI BPCL Credit Card offers an impressive 4.25% value-back on fuel purchases at Bharat Petroleum petrol pumps, making it a top choice for frequent fuel buyers.

Overview

This credit card, a collaborative effort between SBI and Bharat Petroleum, brings numerous benefits, especially for those who make regular fuel purchases. For a moderate joining fee of Rs. 499, the rewards and savings on offer are quite attractive.

WHY SHOULD YOUR FRIENDS & FAMILY APPLY FOR SBI BPCL CREDIT CARD

- 2,000 Activation Bonus Reward Points worth Rs 500 on payment of joining fee

- 4.25% Valueback – 13X Reward Points on fuel purchases at BPCL petrol pumps

- 3.25% + 1% Fuel surcharge waiver on every BPCL transaction Upto Rs 400

- 5X Reward Points on every Rs 100 spent at Groceries, Departmental Stores, Movies & Dining

- Get 1 Reward Point for every Rs 100 spent on non-fuel retail purchases

- 10% Instant Discount with SBI Card during Big E-commerce Sales

Key Highlights

- 4.25% value-back on fuel purchases at BPCL pumps

- Up to 5X reward points on groceries, dining, and more

- Low joining and annual fees (Rs. 499)

- 2,000 bonus reward points on first-time usage

Reward Points Structure

The SBI BPCL Credit Card provides significant rewards on various categories:

| Category | Reward Points |

|---|---|

| Fuel at BPCL | 13X points |

| Groceries, Dining, Movies | 5X points |

| Other Retail Purchases | 1 point per Rs. 100 |

For every Rs. 4,000 spent on fuel at BPCL pumps, you get 13X reward points, equivalent to 4.25% value-back when combined with a 1% fuel surcharge waiver.

Other Benefits

Besides reward points, the card comes with several other perks:

- Contactless transactions

- EMI conversion options for purchases over Rs. 2,500

- Welcome benefit of 2,000 points worth Rs. 500

Fees & Charges

| Fee Type | Amount |

|---|---|

| Joining Fee | Rs. 499 |

| Annual Fee | Rs. 499 (Reversed on spending Rs. 50,000 annually) |

| Finance Charges | 3.5% per month |

| Late Payment Fee | Rs. 0 to Rs. 1,300 based on amount due |

Eligibility & Documentation

To apply for this card, ensure you meet these criteria:

- Age: 18-60 years

- Occupation: Salaried or self-employed

Additionally, a good credit score (750+) will improve your chances of approval.

Frequently Asked Questions

Q: How can I apply for the SBI BPCL Credit Card?

A: You can apply online through SBI’s official website or visit any SBI branch for offline application.

Q: What’s the maximum fuel surcharge waiver?

A: The card offers a 1% waiver on transactions up to Rs. 4,000, with a maximum of Rs. 100 per billing cycle.

Q: Can I check my application status online?

A: Yes, you can track it on the SBI Card official website using your application number.