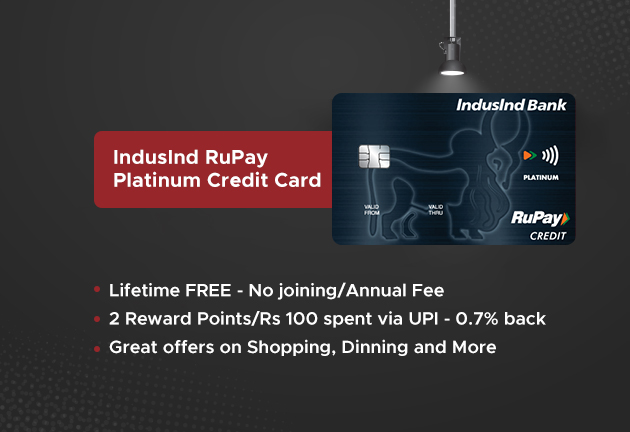

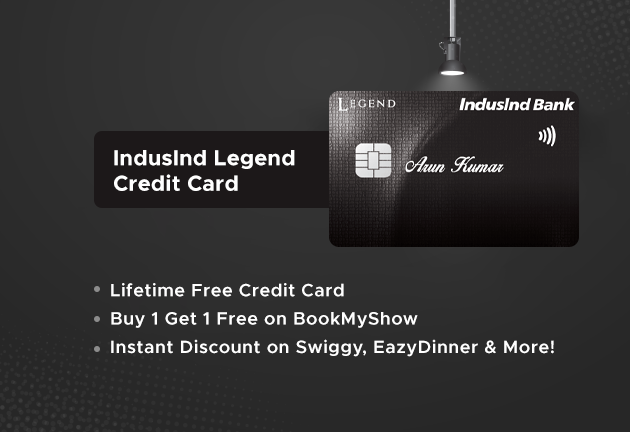

IndusInd Bank Legend Credit Card: A Comprehensive Review

Is the IndusInd Bank Legend Credit Card worth it? Absolutely! This premium credit card offers a one-time issuance charge and no annual fees thereafter, making it a rare gem in the premium card segment.If you’re interested in comparing it with other premium cards, check out our detailed review of the ICICI Emeralde Credit Card benefits, another top-tier option in the market.

Overview

The IndusInd Bank Legend Credit Card is a lifetime free card, packed with features that cater to frequent travelers, golf enthusiasts, and those who enjoy dining out. It brings a host of benefits including travel insurance, reward points, and exclusive golf sessions.Alternatively, if you’re looking for more budget-friendly travel credit cards, you may want to consider the Axis Bank My Zone Credit Card review.

Key Features

Welcome Benefits

| Benefit | Details |

|---|---|

| Complimentary Stay | One or two nights at Oberoi Hotels |

| Luxury Shopping Vouchers | Montblanc India Retail Boutiques |

| E-shopping Vouchers | Amazon, Big Bazaar, Flipkart, etc. |

Reward Points

Earn 1 reward point for every ₹100 spent during weekdays and 2 points on weekends. Points can be redeemed for:

- Cash Credit (1 point = ₹0.75)

- IdusMoments (lifestyle products)

- Airline Miles (InterMiles and Vistara)

- Payments with partner merchants

If you want more flexibility in redeeming points, the IDFC First WOW Credit Card review is also worth checking out, especially for everyday rewards.

Additional Perks

| Perk | Details |

|---|---|

| Airport Lounge Access | Two domestic visits per quarter |

| Golf Sessions | Complimentary once a month |

| Movie Tickets | Buy one, get one free up to three times a month |

| Fuel Surcharge Waiver | No charges at any petrol pump |

| Dining Discounts | 25% to 50% off at select restaurants |

For those who frequently fill up on fuel, you might also be interested in the SBI BPCL Credit Card review, which provides fuel-related perks.

PARTNER DISCOUNTS

- Upto Rs 400 Off on Orders Above Rs 2000 on Ajio

- Rs 100 Off on purchase of Food & Beverage on Orders Above Rs 350 on PVR

- Additional 15% Off on Lifestyle on Orders Above Rs 1999

- Get Upto Rs 1000 Off on Flight & Hotel bookings on EaseMyTrip

- Get 15% discount (upto Rs 500) on Orders Above Rs 1500 on EazyDiner

For other cards offering partner discounts, explore the Axis Neo Credit Card benefits, which has unique offers on shopping and dining.

Eligibility Criteria

To apply for the IndusInd Bank Legend Credit Card, one must meet the following criteria:

- Minimum age: 21 years

- Maximum age: 60 years

- Minimum monthly income: ₹25,000

- Stable employment: Minimum two years in total and one year with the current employer

- Residential Stability: One year at the current rented address or ownership of a house

If you don’t meet these requirements, you might want to consider cards with simpler eligibility like the HSBC Live Credit Card.

Required Documents

- Aadhaar number

- PAN card

- Proof of residence (if Aadhaar is not updated)

- Six months of bank statements (optional)

Pros and Cons

| Pros | Cons |

|---|---|

| No annual fees | No lost card liability cover |

| Complimentary travel perks | Minimum spend for some rewards |

| Dining discounts | Limited airport lounge visits |

For a more fuel-focused option, the Axis Indian Oil Credit Card offers excellent benefits for frequent drivers.

Conclusion

The IndusInd Bank Legend Credit Card is an excellent choice for those seeking a premium card with no annual fees, generous welcome benefits, and a plethora of perks. Perfect for frequent travelers, it ensures your journeys are luxurious and rewarding. However, the lack of liability cover for lost cards could be a downside for some. Overall, it’s a robust option for those who want to maximize their credit card benefits without the burden of annual fees.

If you’re comparing it with other premium options, also consider the AU Altura Plus Credit Card for an equally premium experience.