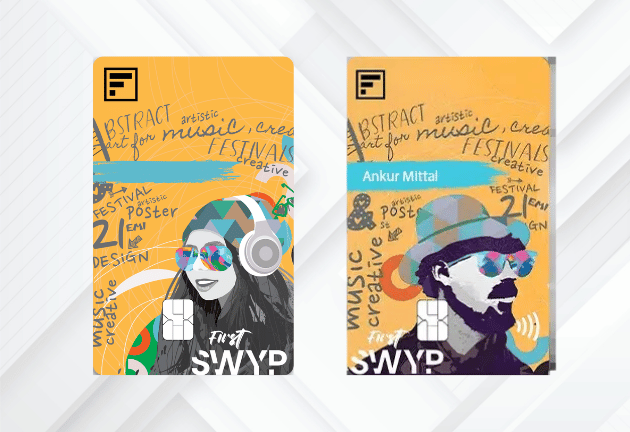

IDFC FIRST SWYP Credit Card Review: Features, Benefits & Fees

Looking for a credit card that’s tailored to your lifestyle? IDFC FIRST SWYP Credit Card offers a plethora of benefits and features specifically designed for young individuals aged 18-35.

Features and Benefits

The IDFC FIRST SWYP Credit Card is loaded with perks that make spending enjoyable and rewarding. Here’s a quick rundown:

| Feature | Details |

|---|---|

| Welcome Bonus | – 1,000 Reward Points on 1st successful EMI transaction – 1-year Times Prime Membership on a minimum spend of ₹30,000 – Free Lenskart Gold Membership |

| Travel Benefit | 10% off on flights or hotels up to ₹500 on transaction value above ₹5,000, valid once per quarter via EaseMyTrip |

| Dining Benefit | – 25% discount up to ₹100 on movie tickets via Paytm Mobile App once a month – 10% instant discount up to ₹100 on purchases over ₹999 on TataCliQ once a month |

| Fuel Surcharge | 1% waiver on charges at all fuel stations across India, up to ₹200/month |

| Lounge Access | 4 free railway lounge access in a calendar quarter to participating lounges in India |

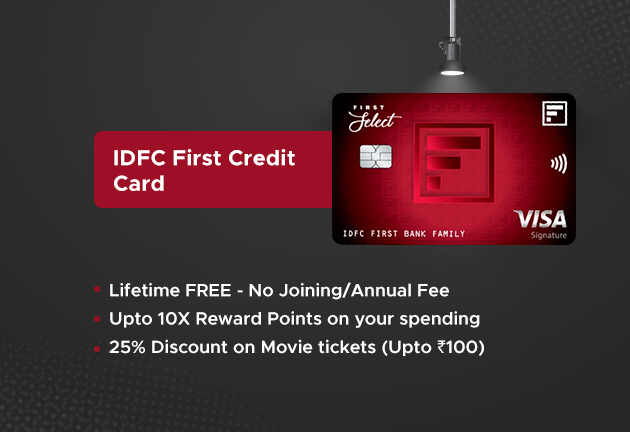

For a comparison of similar cards, check out our review of the IDFC FIRST WOW Credit Card.

Fees and Charges

While the IDFC FIRST SWYP Credit Card offers numerous benefits, it’s important to consider the associated fees:

| Type | Charges |

|---|---|

| Annual Percentage Rate (APR) | Not Applicable |

| Joining Fee | ₹499 |

| Annual Fee | ₹499 |

| Card Replacement Fee | ₹100 |

| Foreign Transaction Fee | 3.50% |

| Fuel Transaction Surcharge | 1% |

| Late Payment Charges | 15% of Total Amount Due (minimum ₹100, maximum ₹1,250) |

Pros and Cons

Every credit card has its upsides and downsides. Here’s a balanced view:

Pros

- Convert eligible transactions into EMIs at any point

- Welcome offers include Times Prime membership and Lenskart Gold membership

- Free roadside assistance

- Exclusive access to railway lounges

- Discounts at various partner merchants

For other cards with unique features, you can check out our Axis Magnus Card Review or the IDFC FIRST Power Credit Card Review.

Cons

- Charges reward redemption fee of ₹99

- Airport lounge access requires fulfilling referral criteria

- No option of paying minimum amount from card statement

Who Should Get This Card?

If you resonate with the following points, the IDFC FIRST SWYP Credit Card may be perfect for you:

- You are aged between 18-35 years

- Enjoy dining, traveling, and shopping

- Aim to build or improve your credit history

For an alternative option for young professionals, you might want to explore the Axis Neo Credit Card or the SBI SimplySave Credit Card.

How to Apply

Applying for this card is straightforward:

- Visit the official website of IDFC FIRST Bank and locate the SWYP Credit Card section.

- Click on the “Apply Now” button.

- Fill in the application form with your personal, financial, and employment details.

- Upload the required documents like identity proof, address proof, and income proof.

- Submit the application form and await approval.

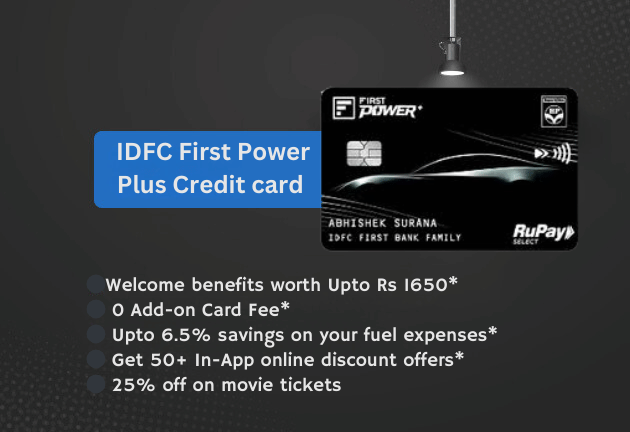

For other credit card options from IDFC FIRST, check out the IDFC FIRST Power Plus Credit Card.

Eligibility and Documentation

Make sure you have a stable source of income and the following documents:

- Proof of identity: PAN Card, Aadhaar Card, Passport, etc.

- Proof of address: Utility Bill, Passport, Driving License, etc.

- Proof of income: Latest salary slips, Form 16, Bank statement

For those looking for more cashback rewards, check out our review of the SBI Cashback Credit Card.