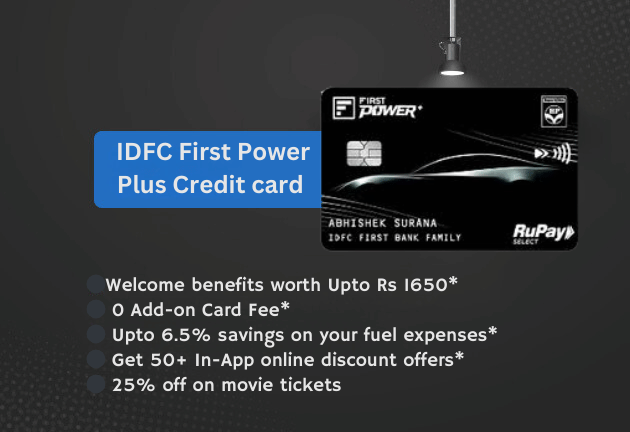

IDFC First Power Plus Credit Card Review: Is It Worth It?

IDFC FIRST Power Plus Credit Card offers significant savings on your HPCL fuel expenses along with various other benefits. If you frequently spend on fuel and groceries, this card could be a great choice for you.

Fuel and Rewards Benefits

The IDFC FIRST Power Plus Credit Card provides up to 6.5% savings on HPCL fuel purchases. You earn 30 reward points for every Rs.150 spent on fuel, capped at 2,400 reward points per statement cycle. The standard Power version gives up to 5% savings.You may also want to explore other fuel credit cards like the SBI BPCL Credit Card or the Axis Indian Oil Credit Card.

Non-Fuel Benefits

This card doesn’t just stop at fuel benefits. You earn up to 5% rewards on utility bills, grocery shopping, and IDFC FIRST FASTag recharges. The base variant offers 2.5% savings on the same categories. Here is a quick comparison. You can check out other IDFC FIRST credit card offerings like the IDFC FIRST WOW Credit Card and the IDFC FIRST Bank Credit Card. Here’s a quick comparison:

| Category | Power Card | Power Plus Card |

|---|---|---|

| Fuel Spends | 5% (21 points per Rs. 150) | 6.5% (30 points per Rs. 150) |

| Grocery & Utility | 2.5% (15 points per Rs. 150) | 5% (30 points per Rs. 150) |

| FASTag Recharges | 2.5% (15 points per Rs. 150) | 5% (30 points per Rs. 150) |

For UPI and other retail spending, the Power variant provides 2 reward points per Rs. 150, whereas the Power Plus offers 3 reward points.If you’re considering cards for grocery and utility bills, also check out the Axis Bank My Zone Credit Card.

Welcome Benefits

Both variants come with attractive welcome bonuses. Opt for the Power card to receive Rs. 250 cashback on your first HPCL fuel spend of Rs. 250 or more within 30 days of card setup. The Power Plus card offers a Rs. 500 cashback on a similar spend. Additional offers include:

- Rs. 1,000 discount on Zoomcar rentals (minimum 2-day booking)

- 5% cashback on first EMI conversion within 30 days (up to Rs. 1,000)

- Up to 50% off on Eco Rent A Car and Europcar rentals

You can also consider checking out other cashback cards like the SBI Cashback Credit Card.

Additional Perks

The Power Plus card includes extra perks like airport lounge access once per quarter with a minimum monthly spend of Rs. 20,000, 25% off on movie tickets, and complimentary roadside assistance worth Rs. 1,399.For premium travel perks, you might want to explore the ICICI Emeralde Credit Card or Amex MRCC Credit Card.

Fees and Charges

Here’s a breakdown of the fees:

| Card Type | Joining/Annual Fee |

|---|---|

| Power | Rs. 199 |

| Power Plus | Rs. 499 |

Moreover, you can get an annual fee waiver if you meet the spending criteria—Rs. 50,000 for the Power card and Rs. 1.5 lakh for the Power Plus card.You can compare it with other entry-level cards like the Axis Neo Credit Card.

Should You Get This Card?

If you are someone who spends significantly on HPCL fuel and groceries, opting for the IDFC FIRST Power or Power Plus Credit Card could be quite beneficial. The rewards and savings often outweigh the low annual fee, and the welcome bonuses make it even more attractive.If you’re considering alternatives, you can check out the IDFC FIRST Power Credit Card.

Conclusion

Overall, the IDFC FIRST Power Plus Credit Card is geared towards HPCL loyalists and frequent drivers. Its comprehensive rewards program covers various spending categories, making it versatile for everyday use. However, if you prefer direct cashback or have other specific lifestyle needs, you might want to explore other options such as the Flipkart Axis Bank Credit Card or the AU Altura Plus Credit Card.