HDFC Bank Marriott Bonvoy Credit Card Review: Is It Worth It?

The HDFC Bank Marriott Bonvoy Credit Card offers great benefits for frequent travelers, including free night awards, elite night credits, and more.

Overview

| Type | Co-brand Travel Credit Card |

|---|---|

| Reward Rate | ~2% |

| Joining Fee | 3,000 INR + GST |

| Best for | Joining/Renewal benefits |

| USP | Free Night Awards |

Fees & Benefits

The joining fee of 3,000 INR + GST offers a free night award valued up to 15,000 points. The same applies to the renewal fee, making it a lucrative option. However, there is no renewal fee waiver, which might be a concern.

If you are looking for another credit card with renewal benefits, you may want to check out the IDFC First Power Credit Card Review, which offers great value.

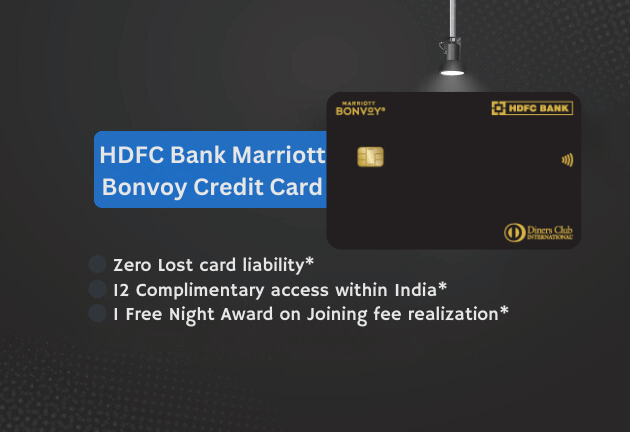

Design

The card sports a neat, elegant, and simple design with a black color and golden prints. While it gives off premium vibes, some might find it a bit too monochromatic and wish for a more colorful version in the future.

Rewards

Depending on the spending category, the reward rate varies:

| Spend Type | Marriott Bonvoy Points per 150 INR | Reward Rate % |

|---|---|---|

| Regular Spends (Domestic & Intl) | 2 | ~0.66% |

| Travel, Dining, Entertainment | 4 | ~1.33% |

| Marriott Hotels | 8 | ~2.66% |

For higher rewards on domestic and international spends, you can also explore the Axis Magnus Card which offers attractive reward rates for premium users.

Milestone Benefit

For high spenders, reaching specific milestone thresholds offers substantial rewards:

| Spend Requirement | Milestone Benefit | Reward Rate |

|---|---|---|

| 6 Lakhs | 1 Free Night (cumulative) | ~1.2% |

| 9 Lakhs | 1 Free Night (cumulative) | ~1.7% |

| 15 Lakhs | 1 Free Night (cumulative) | ~1.5% |

Free night awards are limited to bookings requiring up to 15,000 points, although you can club points from your Marriott Bonvoy account for more high-value stays.

Elite Night Credits

Cardholders will receive 10 Elite Night Credits within 60 days of paying the joining or renewal fee. These credits help you climb the tiers of the Marriott Bonvoy loyalty program faster, inching you closer to Gold, Platinum, or even Titanium status.

If you’re interested in more premium-tier credits and rewards, the ICICI Emeralde Credit Card might also suit your needs.

Silver Elite Status

Upon getting the card, you’ll also receive complimentary Silver Elite Status, which comes with a priority late checkout and 10% more points on Marriott stays. While Silver Elite isn’t game-changing, it’s still a nice perk.

Airport Lounge Access

The card provides 12 domestic and 12 international complimentary lounge accesses annually, without any quarterly capping. Additionally, since it’s on the Diners Club platform, you can access lounges directly by swiping the card.

For those who travel frequently and prioritize lounge access, the Axis Bank My Zone Credit Card offers lounge access along with other travel-centric benefits.

Golf Benefit

Enjoy 2 games or lessons per quarter, a fantastic offer for golf enthusiasts. However, booking these may require a bit more effort via email.

If you’re into premium experiences such as golf and more, the IndusInd Bank Legend Credit Card could be another card to consider.

The time for points transfer and free night award fulfillment is quite long at 12 weeks, which might be a deterrent.

Should You Get It?

This card is worthwhile if you often stay at Marriott hotels, are close to leveling up in the Bonvoy loyalty program, or find higher value for Marriott Bonvoy points.

Getting the Card

You can apply for the card on either the Marriott or HDFC Bank website. Existing HDFC credit cardholders can request it as an additional floater card.

Bottomline

Despite some drawbacks in the reward rates, the card offers high-value benefits for its fee, making it a solid choice for Marriott loyalists and frequent travelers.