HDFC Bank Diners Club Privilege Credit Card Review

HDFC Bank’s Diners Club Privilege credit card is a premium choice for those looking to maximize rewards on their spending. With 4 reward points for every Rs 150 spent and special bonuses on dining and entertainment, this card offers substantial benefits.

Key Features

The Diners Club Privilege credit card comes loaded with features designed to make your spending more rewarding:

- 4 Reward Points for every Rs 150 spent.

- Accelerated rewards for Swiggy and Zomato.For those interested in HDFC’s partnerships with food delivery platforms, you can also check out the Swiggy HDFC Credit Card Review.

- Complimentary annual memberships for Swiggy One and Times Prime.

- 8 complimentary visits per year to domestic and international airport lounges.

- BookMyShow BOGO offer on weekend tickets.

Eligibility Criteria

To qualify for the HDFC Diners Club Privilege card, you must meet the following criteria:

| Salaried | Net Monthly Income > Rs 70,000 |

| Self Employed | ITR > Rs 8.4 Lakhs/Annum |

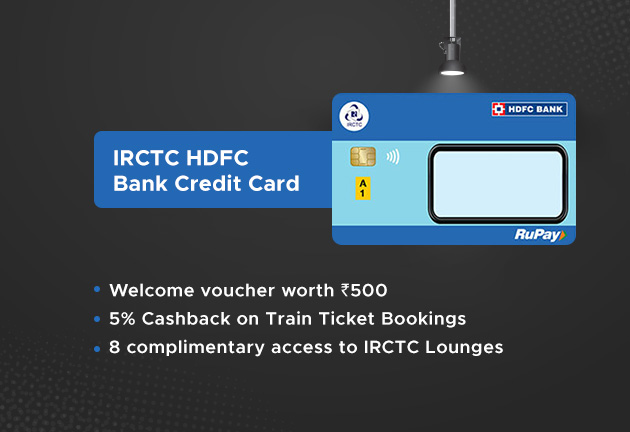

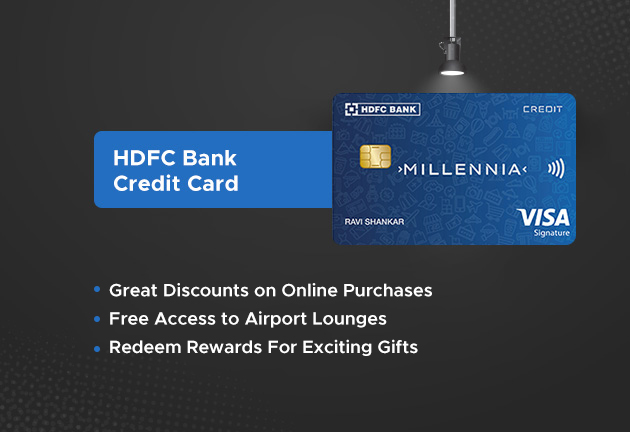

Additionally, those with an existing HDFC credit card with a limit of Rs 3 Lakh can easily upgrade by contacting customer care.For an entry-level HDFC credit card, you may want to explore the HDFC Bank Credit Card Review.

Fees and Charges

| Type | Amount |

|---|---|

| Joining Fee | Rs 2500 + GST |

| Annual Fee | Rs 2500 + GST (waived on spending Rs 3 Lakh/year) |

Upon spending Rs 75,000 in the first 90 days, cardholders receive complimentary Swiggy One and Times Prime memberships.

Reward Points Details

The reward point system for this card is quite comprehensive:

| Spending Category | Reward Points | Equivalent Return |

|---|---|---|

| Retail Spends | 4 RP/Rs 150 | ~1.3% |

| Swiggy and Zomato | 20 RP/Rs 150 | ~6.5% |

Special categories such as EasyEMI, Fuel, Wallets, Rent, Property Management, Packers & Movers, and Government transactions do not earn any rewards.Similar exclusions apply to other cards like the Axis Neo Credit Card.

Quarterly Milestones

Spend Rs 1.5 Lakh in a calendar quarter to earn a Rs 1500 gift voucher from partners like Marriott Experience, Decathlon, Barbeque Nation, O2 Spa, and Lakme Salon.Interested in similar perks? Check out the HDFC Marriott Bonvoy Credit Card Review.

SmartBuy Program

The HDFC SmartBuy program offers accelerated rewards:

| Category | Reward Points | Reward Rate |

|---|---|---|

| IGP.com | 10X | 13.3% |

| Flights | 5X | 6.6% |

| Hotels | 10X | 13.3% |

| Redbus | 5X | 6.6% |

| Nykaa | 5X | 6.6% |

Complimentary Airport Lounge Access

Cardholders get 8 complimentary visits per year to domestic and international lounges, provided they spend over Rs 15,000 in the previous quarter.For more airport lounge access offers, check out the IDFC First Bank Wealth Debit Card Review.

BookMyShow Offer

Enjoy Buy 1 Get 1 Free on movie/non-movie weekend tickets via BookMyShow. Maximum discount is Rs 250 per ticket, up to 2 free tickets per calendar month.You may also be interested in similar benefits from the Tata Neu HDFC Bank Credit Card.

Rewards Redemption

Rewards can be redeemed via the SmartBuy portal for flights/hotels, gift vouchers, or cash. The value per point varies:

| Option | Value of 1 RP |

|---|---|

| Flights/Hotels | 50 paise |

| Airmiles | 0.5 Airmiles |

| Rewards Catalogue | 20 to 35 paise |

Final Thoughts

The HDFC Bank Diners Club Privilege credit card offers great value with its robust rewards system and exclusive benefits. However, its acceptance at offline stores can be an issue, although this has been improving with RuPay integration. Overall, it’s a smart choice for those who want to maximize their rewards and enjoy premium perks.

For more premium card options, you might want to check out the Axis Bank My Zone Credit Card or the RBL Bank Icon Credit Card.

Got thoughts on this card? Share them in the comments below!