Axis Indian Oil Credit Card Review: An In-depth Look

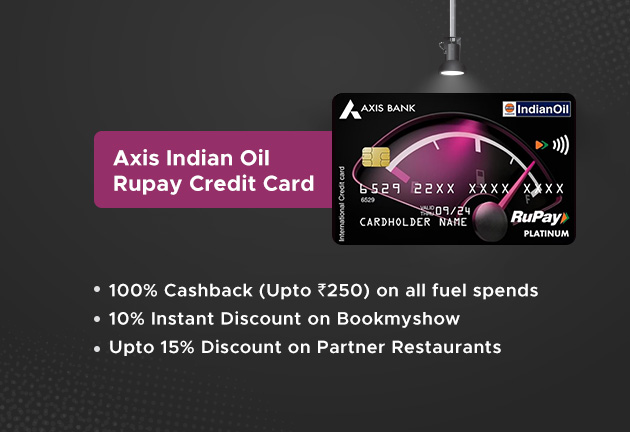

Looking to save on fuel expenses? The Axis Indian Oil Credit Card might just be the perfect solution for you. This card is specifically designed for individuals who spend a significant amount on fuel, offering substantial value-back in the form of reward points at IndianOil outlets.

Features & Benefits

The IndianOil Axis Bank Credit Card comes with numerous features that make it stand out, especially for those who regularly spend on fuel. Here are the key highlights:

Up to 4% Value-Back

Cardholders can enjoy up to 4% value-back on fuel transactions at IndianOil outlets. This is achieved by earning 20 EDGE reward points for every ₹100 spent on fuel, applicable on transactions between ₹400 and ₹4,000 per month.

Additionally, the card offers 1% value-back on online shopping, earning 5 EDGE reward points for every ₹100 spent, applicable on transactions between ₹100 and ₹5,000.

You can also compare this with the Axis Bank My Zone Credit Card which offers rewards on entertainment spends and is a great alternative for non-fuel categories

Additional Benefits

- Welcome Benefit: Earn EDGE reward points equivalent to the value of your first fuel transaction (up to 1,250 points) within the first 30 days of card issuance.

- Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver of up to ₹50 per statement cycle on fuel spends worth ₹400 to ₹4,000.

- Annual Fee Waiver: The annual fee of ₹500 is waived off if you spend ₹3.5 lakh in the previous year.This is similar to the fee structure found in the Flipkart Axis Bank Credit Card, which also offers exciting cashback options.

- Entertainment & Dining: Get a 10% discount on booking movie tickets through BookMyShow and up to 15% off on dining bills at partner restaurants via EazyDiner.

Moreover, for those with the Rupay variant of the card, UPI payments are facilitated through linking the card to UPI apps like Google Pay, PhonePe, and Paytm.If you are exploring UPI-enabled credit cards, the Airtel Axis Bank Credit Card might also be a great option

Fees & Charges

The IndianOil Axis Bank Credit Card comes with the following fees and charges:

| Type of Charge | Amount |

|---|---|

| Joining Fee | ₹500 |

| Annual Fee | ₹500 (Waived off on spending ₹3.5 lakh in a year) |

| Finance Charges | 3.4% p.m. (49.36% p.a.) |

| Late Payment Fee | Depends on the outstanding amount (ranges from Nil to ₹1,200) |

Eligibility Criteria

To apply for the IndianOil Axis Bank Credit Card, applicants must meet the following eligibility criteria:

- Age: 18 to 70 years

- Occupation: Salaried or Self-employed

Additional documents may be required for verification. For a detailed list of acceptable documents and serviceable cities, you can check the bank’s official website.

Should You Apply?

The IndianOil Axis Bank Credit Card is an excellent option for individuals with monthly fuel expenses ranging between ₹3,000 to ₹5,000. The card provides substantial rewards and benefits for fuel transactions, among other perks like dining and movie discounts. However, the annual fee waiver that requires spending ₹3.5 lakh per year might be challenging for some users.

If you are primarily looking for a fuel credit card with added advantages, this card could be a great fit. On the other hand, if you need a card that offers benefits across multiple spending categories, you might want to explore other options available in the market, like the Axis Magnus Card, which offers more premium benefits across different categories.

Comparison with Other Fuel Credit Cards

If you are still undecided, here is a quick comparison of other fuel credit cards:

| Card | Joining Fee | Annual Fee | Fuel Savings |

|---|---|---|---|

| IDFC FIRST Power+ Credit Card | ₹499 | ₹499 | 5% on HPCL fuel & LPG |

| IndianOil HDFC Credit Card | ₹500 | ₹500 | 5% on IndianOil fuel |

| BPCL SBI Card | ₹499 | ₹499 | Up to 4.25% on BPCL fuel |

| ICICI Bank HPCL Coral Credit Card | ₹199 | ₹199 | Up to 3.5% on HPCL fuel |

Each of these cards offers unique benefits and might better suit different spending habits. Evaluate your monthly expenditures and choose the card that provides the most value for your specific needs.