Axis Atlas Credit Card Benefits and Features for Travel

The Axis Bank Atlas Credit Card offers an array of travel benefits that make every journey worthwhile. With rewards, privileges, and tiered benefits, it provides a holistic travel experience for cardholders.

Special Features

Designed specifically for travel enthusiasts, the Axis Atlas Credit Card comes with unique features to make your trips more rewarding:

- 2500 EDGE Miles as a welcome benefit upon your first transaction within 37 days of account opening.

- EDGE Miles can be redeemed for flights, hotels, and experiences.

- Access to the ATLAS dashboard in the Axis Bank Mobile App to manage your rewards.

Tiered Benefits

Upon receiving the card, you start with the Silver tier. Depending on your annual spending, you can elevate to Gold and then Platinum, unlocking additional benefits:

| Membership Tier | Annual Spend | Earned EDGE Miles |

|---|---|---|

| Silver | Starting Tier | 2 EDGE Miles per Rs 100 spent |

| Gold | After Rs 7.5 Lakhs | 5 EDGE Miles per Rs 100 on travel |

| Platinum | After Rs 15 Lakhs | 5 EDGE Miles per Rs 100 on travel |

If you’re looking for more benefits, you might also consider the Axis Bank My Zone Credit Card, which offers lifestyle rewards.

Annual and Milestone Benefits

For each year you successfully pay your card’s annual fee, you receive up to 5000 EDGE Miles, depending on your tier. Additionally, achieving spending milestones earns you extra EDGE Miles:

| Spend Amount (INR) | EDGE Miles Earned |

|---|---|

| 3,00,000 | 2500 |

| 7,50,000 | Additional 2500 |

| 15,00,000 | Additional 5000 |

For comparison, check out the HDFC Bank Marriott Bonvoy Credit Card if you prefer hotel-related rewards.

Privileges

The ATLAS card provides exclusive privileges including:

- Domestic & International Lounge Access

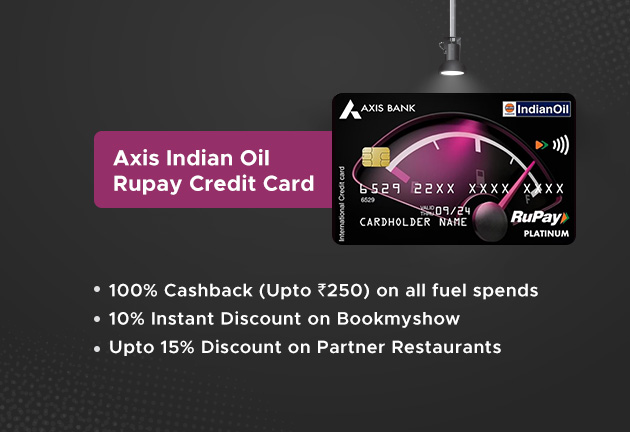

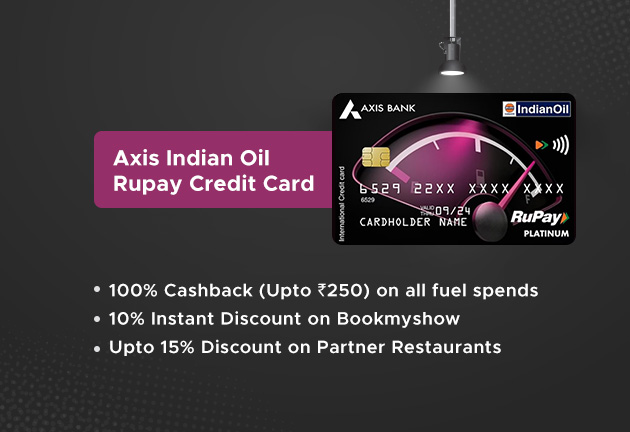

- Axis Indian Oil Credit Card offers great fuel-related privileges, which is an alternative if you’re looking for rewards on fuel spends.

- Miles Transfer Program via dedicated portal

- 24*7 Concierge Desk

- Up to 25% discount at over 10,000 restaurants through EazyDiner

Eligibility Criteria & Documentation

To apply for the Axis Atlas Credit Card, the primary cardholder must be between 18 and 70 years old, with a net annual income of Rs. 12 lakhs for salaried individuals, and Rs. 15 lakhs for self-employed individuals. Required documents include a PAN card, proof of income, and proof of residence.

For more premium credit cards with exclusive benefits, you might want to check out the IndusInd Bank Legend Credit Card.

Fees and Charges

| Type | Amount |

|---|---|

| Joining Fee | Rs 5000 |

| Annual Fee (from 2nd year) | Rs 5000 |

| Finance Charges | 3.60% per month |

| Cash Withdrawal Fees | 2.5% of the cash amount (Min. Rs 500) |

Additional fees include foreign currency transaction fees at 3.50% of the transaction value, and various charges for cheque returns, late payments, and over-limit transactions.For those interested in travel rewards with fewer fees, take a look at the Axis Vistara Infinite Credit Card for a unique travel experience.

Frequently Asked Questions

What is an EDGE Mile? It is Axis Bank’s loyalty currency assigned to ATLAS credit cardholders, where 1 EDGE Mile equals INR 1.

How can I upgrade my membership tier? Tier upgrades are achieved through spending milestones. Spending Rs. 7.5 lakhs upgrades you to Gold, and Rs. 15 lakhs upgrades you to Platinum.

How do I redeem EDGE Miles? You can redeem EDGE Miles through the Axis Bank Mobile App or the Travel Edge website for flights, hotels, and experiences.