AU Altura Plus Credit Card Review: Features, Fees & Benefits

The AU Altura Plus Credit Card is an excellent choice for those seeking maximum benefits from their credit card. It offers a combination of rewards, cashback, and other perks tailored for frequent shoppers and travelers.

Key Highlights of AU Altura Plus Credit Card

| Annual Fee | Rs. 499 + taxes |

| Welcome Benefit | Vouchers worth Rs. 500 |

| Suitable For | Shopping and Rewards |

* Annual fee can be waived off with spends.

Features and Benefits

Welcome Benefits

Get vouchers worth Rs. 500 on a minimum spend of Rs. 10,000 within the first 60 days of card setup.

You can also check out our detailed review of the Axis Magnus Card for comparison with other premium cards that offer great welcome bonuses.

Cashback

Earn 1.5% cashback on POS retail spends at merchant outlets. The maximum cashback per statement cycle is Rs. 100. After reaching the cashback limit, you earn 1 reward point per Rs. 100 spent.

For a cashback-focused card, take a look at the SBI Cashback Credit Card, which provides an alternative with high cashback returns.

Milestone Benefits

Accumulate 500 bonus reward points with retail spends of Rs. 20,000 or more in a calendar month.

Rewards

Get 2 reward points for every Rs. 100 spent on online transactions. No cap on reward points. Redeem for e-vouchers, merchandise, mobile/DTH recharges, and travel bookings.

If you’re keen on rewards, you might also be interested in the Axis Bank My Zone Credit Card, another card that offers great reward points for online purchases.

Railway Lounge Access

Enjoy 2 complimentary lounge accesses per calendar quarter at selected stations across India.

For frequent travelers, check out our review on IDFC First WOW Credit Card to see how it stacks up for lounge benefits.

Fuel Surcharge Waiver

Benefit from a 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 5,000, up to Rs. 150 per statement cycle.

Looking for more fuel-related perks? The Axis Indian Oil Credit Card offers specific benefits on fuel purchases.

PARTNER DISCONTS

- 10%Instant Discount (Upto Rs 1,000) on Flipkart Orders Above Rs 10,000

- Additional 10%Off (Upto Rs 1000) on Myntra

- 15% instant discount (Upto Rs 300 per month) on Tata CLiQ Orders Above Rs 500

- 10% off on Groceries (Upto Rs 100) on Blinkit app orders above Rs 499

For those who enjoy online shopping discounts, you can also check out the Tata Neu HDFC Bank Credit Card for additional savings across Tata brand stores.

Additional Benefits

- Card Liability Cover: Zero liability for fraudulent transactions after reporting loss. Protection against card skimming and online frauds.

- Xpress EMI: Convert transactions worth Rs. 2,000 or more into easy EMIs with flexible repayment options.

Fees & Charges

| Joining Fee | Rs. 499 + taxes |

| Annual Fee | Rs. 499 + taxes |

| Late Payment Fees |

|

If you’re considering other credit cards with competitive fee structures, take a look at the HSBC Live Credit Card for an alternative with a good balance of features and fees.

Eligibility & Documentation

You can apply for the AU Altura Plus Credit Card if:

- You are an Indian resident

- You are aged between 21-60 years

- Add-on cardholders should be 18 years and above

Required documents include:

- Proof of Identity: PAN Card, Aadhaar card, etc.

- Proof of Address: Aadhaar card, Passport, etc.

- Proof of Income: Latest salary slips, Form 16, etc.

How to Apply

Visit the nearest bank branch or call the bank’s toll-free number: 1800 1200 1200 for assistance.

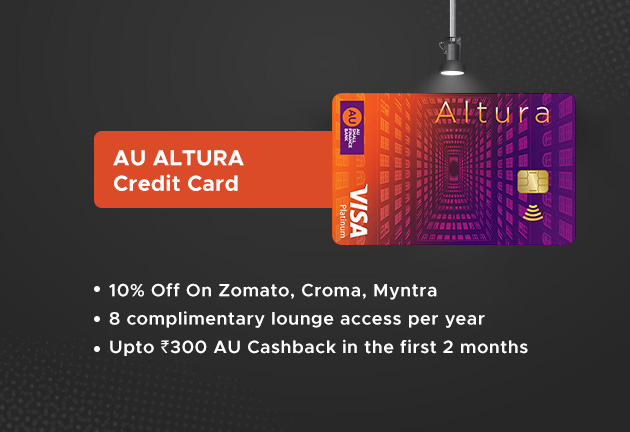

For more details, you can also visit our AU Altura Credit Card Review to understand how it compares with the Altura Plus.