Airtel Axis Bank Credit Card Review: Benefits for Airtel Users

The Airtel Axis Bank Credit Card is an excellent choice for Airtel customers seeking cashback, discounts, and other perks across multiple spend categories. From welcome benefits to airport lounge access, this card packs a punch at an affordable annual fee.

If you’re interested in exploring other popular cards with similar benefits, you might also want to check out the Axis Magnus Card and the Axis Neo Credit Card, which also offer substantial perks across spending categories.

Features & Benefits

This co-branded credit card offers a range of benefits, primarily for Airtel users, but also includes rewards for spending across various brands like Zomato, Swiggy, and BigBasket.For those looking at non-Airtel-focused alternatives, the Axis Bank My Zone Credit Card and the IDFC First Bank Credit Card provide rewards for entertainment and other spending categories.

Welcome Benefits

Upon activation, you receive an Amazon e-voucher worth Rs. 500 as a welcome benefit. This voucher is sent to your registered mobile number within 30 days of your first transaction.For example, utility bills paid via the Airtel Thanks app qualify for cashback, unlike other credit cards. You can compare these benefits with the SBI Cashback Credit Card, which also offers attractive cashback opportunities.

Cashback Benefits

The card offers various cashback rates based on the type of transaction.

| Type of Transaction | Cashback Rate | Capped at |

|---|---|---|

| Airtel Mobile, Broadband, Wifi, & DTH via Airtel Thanks app | 25% | Rs. 250 per month |

| Utility Bills via Airtel Thanks app | 10% | Rs. 250 per month |

| Zomato, Swiggy, BigBasket | 10% | Rs. 500 per month |

| Other Spends | 1% | No limit |

Keep in mind that utility bills paid via platforms other than the Airtel Thanks app, fuel, EMI transactions, and other specific exclusions do not qualify for cashback.

Airport Lounge Access

You get four complimentary domestic lounge visits per year at select airports, provided you spend Rs. 50,000 in the previous three months.This feature is similar to premium cards like the ICICI Emeralde Credit Card, which also offers lounge access but with higher spend requirements.

Other Benefits

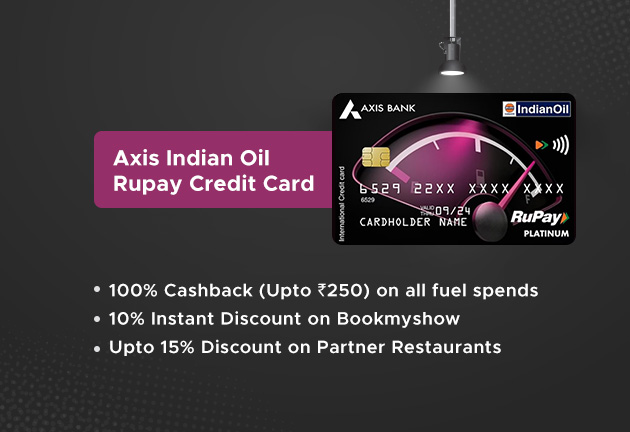

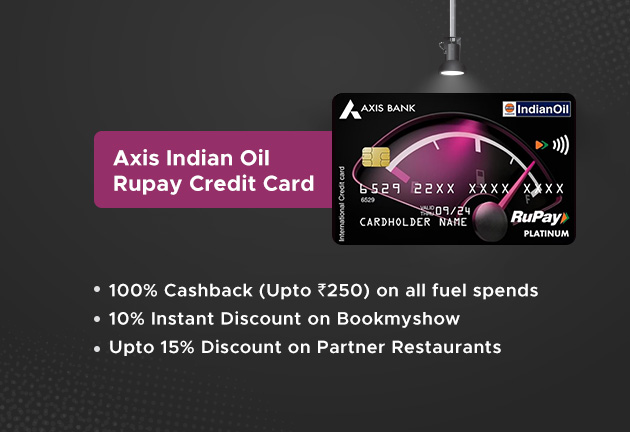

Additional perks include a 1% fuel surcharge waiver (up to Rs. 500 per statement cycle) and up to 20% dining discounts at over 4000 partner restaurants in India.If fuel benefits are a priority, you can also look into the Axis Indian Oil Credit Card for focused rewards on fuel purchases.

Value-back Comparison

Let’s compare the Airtel Axis Bank Credit Card with other popular cards:

| Transaction Type | Transaction Value (in Rs.) | Airtel Axis Bank Credit Card (in Rs.) | Axis Ace Credit Card (in Rs.) | Cashback SBI Card (in Rs.) |

|---|---|---|---|---|

| Electricity Bill | 6,000 | 250 | 300 | 0 |

| Mobile Bill | 3,000 | 150 | 150 | 0 |

| DTH Bill | 1,000 | 100 | 50 | 0 |

| Water Bill | 1,000 | 0 | 50 | 0 |

| Zomato | 2,000 | 200 | 80 | 100 |

| Bigbasket | 5,000 | 300 | 75 | 250 |

| Ola | 2,000 | 20 | 80 | 100 |

| Apparel Purchase | 5,000 | 50 | 75 | 250 |

| Fuel | 5,000 | 0 | 0 | 0 |

| Total | 30,000 | 1,070 | 860 | 700 |

Should You Get This Credit Card?

If you’re an Airtel user, this card offers unbeatable cashback on Airtel spends and utility bill payments, categories often overlooked by other credit cards. However, keep in mind the monthly capping on cashback. For non-Airtel users, the Axis Ace Credit Card is a viable alternative.

Fees and Charges

| Fee Type | Details |

|---|---|

| Joining Fee | Rs. 500 |

| Annual Fee | Rs. 500 |

| Finance Charges | 3.6% per month | 52.86% per year |

| Late Payment Fee | <250: Nil 500-5000: Rs. 500 5001-10000: Rs. 750 10000+: Rs. 1,200 |

Eligibility & Documentation

This card is available exclusively via the Airtel Thanks App. Basic eligibility criteria include:

- Age 18 to 70 years

- Resident of India

Documentation requirements may vary. Make sure to check the detailed list when you apply.

Final Thoughts

The Airtel Axis Bank Credit Card is a fantastic option for Airtel users or those planning to join the Airtel ecosystem. With comprehensive cashback benefits and low fees, it stands out, though monthly cappings might limit some users. Evaluate your spending habits and decide if this card fits your lifestyle.

Should you decide to apply, make the most of its exclusive offers and dive into a world of savings and rewards!