Unlock Exclusive Benefits with IDFC FIRST Bank Credit Card

Are you looking to unlock exclusive benefits with your credit card? IDFC FIRST Bank Credit Card offers a plethora of features designed to make your financial transactions smooth and rewarding.

Application Process

Applying for an IDFC FIRST Bank Credit Card is a seamless and paperless process. Simply visit the bank’s website, fill out a digital form, and verify your details via an OTP sent to your mobile number. Once approved, you will receive your physical credit card in 4-5 working days, and a virtual card instantly on the IDFC FIRST Mobile Banking App.

DOCUMENTS NEEDED

PAN Card/Form 60

Address proof

Colour photograph

ID Proof

Income proof

ELIGIBILITY CRITERIA

Employment Status: Salaried or Self-Employed

Income group: Rs 25,000 per month

Required Age: 21-60 years (Salaried), 25-60 years (Self employed)

Minimum Cibil Score Required: 750+

Rewards and EMI Options

IDFC FIRST Bank Credit Cards offer attractive rewards and EMI conversion options. You can earn reward points on every eligible transaction and redeem them via the bank’s rewards website, net banking, or mobile banking. Converting transactions above ₹2,500 to EMI is also easy through the mobile app or Net Banking.

PARTNER DISCOUNTS

- 10% Instant discount on Flipkart

- 10% Instant discount on Myntra, AJIO, Tata CliQ , 1MG

- 15% Instant discount on Tata CliQ Palette, Sugar cosmetics, Zomato

- 10-20% Instant discounts on Travel bookings on Yatra, Adani one, MMT , GoIbibo etc.

How to Redeem Reward Points

- Visit the rewards website.

- Use the “Reward redemption” section in Net Banking/Mobile Banking.

- Select “Pay with Reward points” for online purchases during the transaction.

- Choose “Pay with Reward points” for in-store purchases at select Pine Lab terminals.

A redemption fee of ₹99 + GST is applicable.

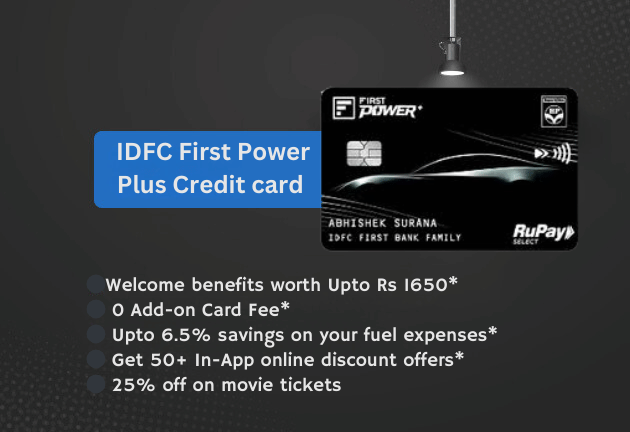

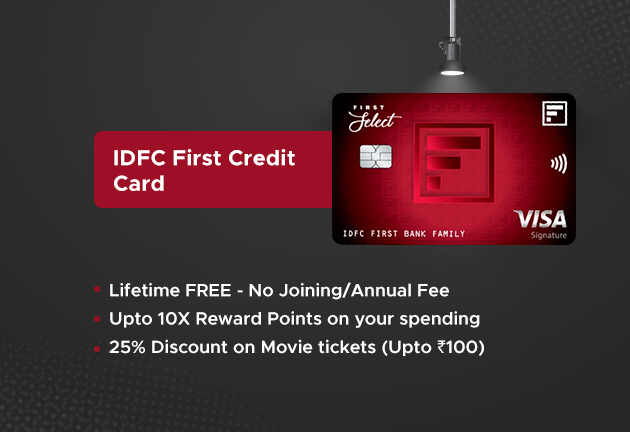

OTHER AMAZING OFFERS

- Upto 10X Reward Points on your spending (value back of upto 2%)

- Rs 500 Gift Voucher on spending Rs 15,000 in the first 90 days

- 25% Discount on Movie tickets (upto Rs 100) on Paytm App

- Complimentary roadside assistance worth Rs 1,399

- 4 Complimentary Railway Lounge visits per quarter

- 4 Complimentary Domestic Airport Lounge visits per quarter on IDFC FIRST Select Credit Card on monthly spends over Rs 5000

EMI Conversion Steps

- At the bottom of your Credit Card page, click on “Convert to EMI”.

- Select the eligible transaction and choose an EMI repayment plan.

- Accept the T&Cs and confirm the conversion.

Exciting Privileges

The credit card offers numerous privileges including complimentary lounge access, spa benefits, and movie discounts. For example, spend a minimum of ₹20,000 in any calendar month to activate lounge/spa benefits for the next month. For movie discounts, use your IDFC FIRST Bank Credit Card voucher code on the Paytm mobile app while purchasing tickets.

Manage Your Card

Managing your IDFC FIRST Bank Credit Card is incredibly straightforward via the bank’s mobile app or Net Banking. From setting up auto-debit for bill payments to generating your Credit Card PIN or blocking your card in case of loss – all these actions can be performed online.

Generate Credit Card PIN

- Login to your Net Banking account or Mobile Banking App.

- Select the Credit Card section.

- Set and verify your new PIN through OTP.

Blocking Your Credit Card

- Navigate to the Accounts section and select Cards.

- On the dashboard, choose temporary or permanent block.

- Send an SMS to 5676732 for quick blocking.

Flexible Payment Options

IDFC FIRST Bank offers multiple payment options to settle your credit card bills: Auto-debit from your IDFC FIRST Bank Savings Account, Mobile Application, Net Banking, UPI, IMPS/NEFT, Cash Deposit, Cheque, and Debit Card.

Why Choose IDFC FIRST Bank Credit Card?

Opting for an IDFC FIRST Bank Credit Card gives you access to numerous perks and a dynamic low APR based on your credit score and repayment behavior. The never-expiring reward points are another added benefit, making your credit card experience rewarding and fulfilling.