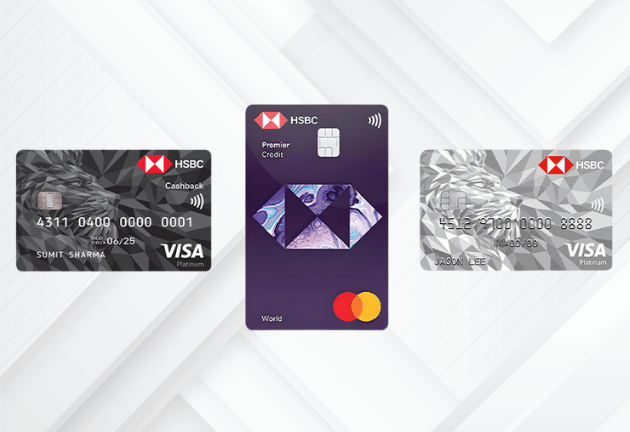

HSBC Premier Credit Card: Unlock Exclusive Travel Benefits

The HSBC Premier credit card offers exclusive travel benefits including access to premium travel services, no foreign transaction fees, and a robust rewards program. This card is perfect for frequent travelers looking to maximize their benefits.

Benefits of the HSBC Premier Credit Card

With the HSBC Premier Credit Card, cardholders enjoy a plethora of exclusive benefits designed to enhance their travel experiences. Here’s a closer look:

Travel Perks

The card offers outstanding travel perks including complimentary access to over 1,000 airport lounges worldwide, travel insurance, and emergency assistance. Additionally, there are no foreign transaction fees, which can save you a considerable amount of money when shopping abroad.If you’re looking for an alternative card with no foreign transaction fees, check out the HDFC Infinia Credit Card for its premium features.

Rewards Program

HSBC Premier cardholders earn rewards on every purchase:

- Earn 2 points per $1 on travel purchases

- Earn 1 point per $1 on all other purchases

For more lucrative rewards programs, consider the Axis Vistara Infinite Credit Card, which offers exclusive travel benefits and rewards catered to frequent travelers.

Fees and Interest Rates

Understanding the fees and interest rates associated with the HSBC Premier Credit Card is crucial:

| Annual Fee | $95 (waived for HSBC Premier clients) |

| Purchase APR | 21.24% to 25.24% |

| Balance Transfer Fee | $10 or 5%, whichever is greater |

| Cash Advance APR | 29.99% |

If you want a credit card with lower annual fees, you may also consider the SBI Prime Credit Card, which offers competitive fees and strong benefits.

Eligibility Requirements

To qualify for the HSBC Premier Credit Card, applicants must maintain an HSBC Premier relationship, which may include a combination of qualifying balances and checking accounts. Meeting these requirements makes applicants eligible for enhanced benefits and personalized services.If you’re considering other premium cards with similar eligibility requirements, the ICICI Emeralde Credit Card is another excellent option for those seeking premium benefits.

How to Apply

Applying for the HSBC Premier Credit Card is straightforward. Interested applicants can visit the HSBC website or contact their Relationship Manager. Ensure you meet the eligibility criteria before applying to smooth the approval process.

Conclusion

The HSBC Premier Credit Card is a sought-after choice for avid travelers and those looking to make the most out of their spending. With comprehensive travel benefits, a lucrative rewards program, and no foreign transaction fees, this card is designed to cater to the needs of discerning customers.If you’re interested in other cards with exceptional travel benefits, the OneCard and Axis Atlas Credit Card are worth exploring.