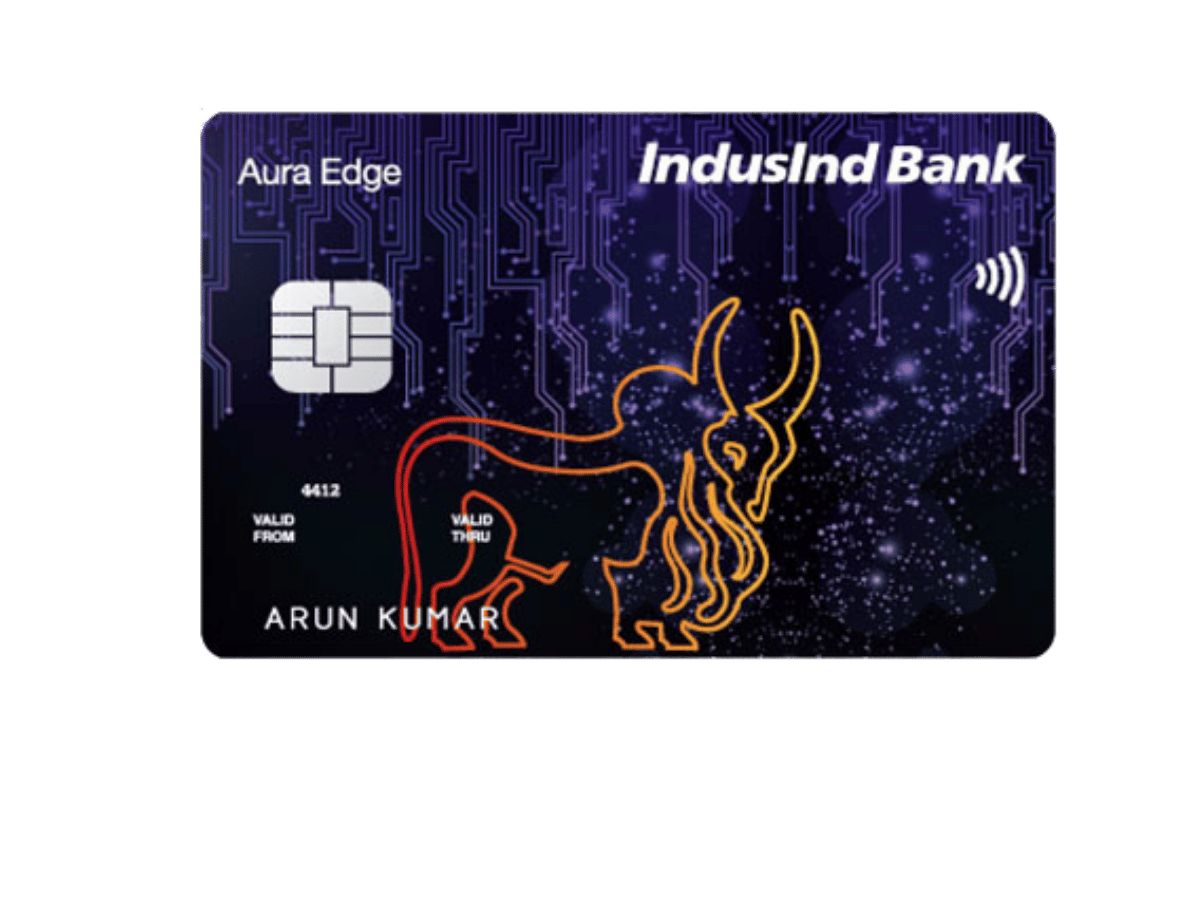

IndusInd Platinum Aura Edge Credit Card: Advantages & Offers

The IndusInd Platinum Aura Edge Credit Card is perfect for avid shoppers and travelers, offering a range of benefits that cater to various spending categories. Whether it’s departmental store expenses, hotel bookings, or restaurant payments, this card delivers great value.

Key Highlights

Here are some of the standout features of the IndusInd Platinum Aura Edge Credit Card:

- Best Suited for: Shopping

- Joining Fee: Rs. 500 (Waived if applied through Paisabazaar)

- Annual Fee: Nil

- Minimum Income Requirement: Rs. 25,000 per month

- Top Feature: 4 savings points per Rs. 100 spent at departmental stores and grocery

For those who prefer low-cost credit cards, the IDFC First Power Credit Card Review might also be of interest.

Features and Benefits

The IndusInd Platinum Aura Edge Credit Card provides a substantial value back in terms of reward points for your purchases. Additional benefits include fuel surcharge waiver, insurance coverage, and complimentary vouchers.You can also explore other premium cards like the IndusInd Bank Legend Credit Card Review, which offers exclusive travel benefits.

Rewards Plan

This credit card allows you to earn reward points based on your spending categories. The card is divided into several plans:

| Plan Name | Spend Categories | Savings Points per Rs. 100 |

|---|---|---|

| Platinum Aura Edge Shop Plan | Departmental Stores | 4 |

| Electronic Items | 2 | |

| Restaurant Bills | 1.5 | |

| Other Spends | 0.5 | |

| Platinum Aura Edge Home Plan | Grocery Shopping | 4 |

| Medical Spends | 1.5 | |

| Utility Bills | 1.4 | |

| Other Spends | 0.5 | |

| Platinum Aura Edge Travel Plan | Hotel Expenses | 4 |

| Flight Tickets | 2.5 | |

| Car Rentals | 1.5 | |

| Other Spends | 0.5 | |

| Platinum Aura Edge Party Plan | Restaurant Bills | 4 |

| Departmental Stores | 2 | |

| Movie Tickets | 1.5 | |

| Other Spends | 0.5 |

If you are a frequent online shopper, you may also want to check out the Flipkart Axis Bank Credit Card Review for exclusive offers on Flipkart purchases.

Reward Redemption Options

You can redeem your rewards for:

- Cash Credits: 1 reward point = Rs. 0.35

- InterMiles: 100 reward points = Up to 100 InterMiles

- Vistara Miles: 100 reward points = 50 CV Points

- Pay with Rewards: Up to 25% of the bill payment amount

Note: For the cash credit option, a maximum of 10,000 reward points can be redeemed in one statement cycle.

Fees and Charges

| Fee/Charge | Amount/Rate |

|---|---|

| Joining Fee | Rs. 500 (Nil, if applied via Paisabazaar) |

| Annual Fee | Nil |

| Finance Charges | 3.95% p.m. (47.40% p.a.) |

| Late Payment Charges | Varies from Nil to Rs. 1,300 depending on outstanding amount |

The IndusInd Platinum Aura Edge Credit Card has no annual fee, making it an attractive option for those who want to maximize points without worrying about yearly costs.For a no-frills alternative, check out the Amex MRCC Credit Card Review, which also offers rewards without annual fees.

Eligibility and Documentation

Interested in applying for this credit card? Ensure you meet the following criteria:

- Age: 21 to 60 years

- Occupation: Salaried or Self-employed

- Minimum Income: Rs. 20,000 per month

Required documents will vary, so it’s best to check directly with IndusInd Bank for the full list.If you are looking for other credit cards from the same issuer, you might want to read our review of the IndusInd Bank Platinum RuPay Credit Card.

Conclusion

The IndusInd Platinum Aura Edge Credit Card offers numerous benefits, including flexible rewards, insurance coverage, and fuel surcharge waivers. Ideal for frequent shoppers and travelers, this card is a solid choice if you’re looking to earn rewards without paying an annual fee.If you’re also exploring other shopping-centric cards, take a look at the Axis Neo Credit Card Benefits for additional perks.