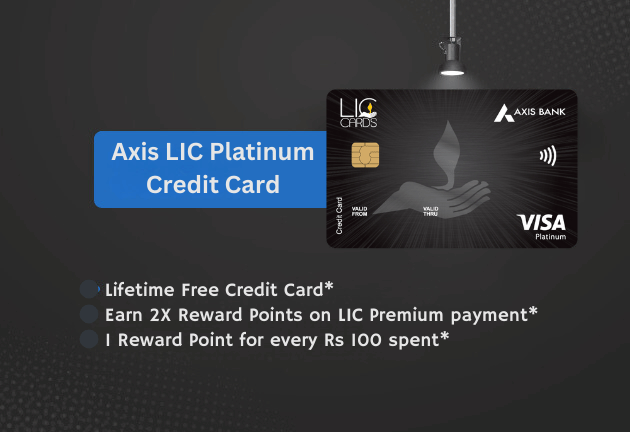

Axis LIC Platinum Credit Card Review: Comprehensive Overview

The Axis LIC Platinum Credit Card offers accelerated rewards on LIC premium payments. This card is tailored for individuals who seek benefits while managing their LIC payments, giving a unique edge over other typical credit cards.

Features and Benefits

The LIC Axis Bank Platinum Credit Card packs a punch when it comes to features and benefits. Here’s what you can expect:

Accelerated Rewards Programme

This card provides a lucrative rewards program:

- Rewards on LIC Premium Payments: 2 reward points for every ₹100 spent.

- Rewards on International Spends: 2 reward points for every ₹100 spent.

- Rewards on Other Retail Spends: 1 reward point for every ₹100 spent.

If you’re seeking more versatile rewards, consider reading our review of the Axis Magnus Card for premium benefits and enhanced rewards on other transactions.

Complimentary Insurance Covers

Stay covered with these additional insurance benefits:

- Lost card liability insurance cover up to the credit limit.

- Personal accident insurance cover of ₹3 Lakh.

- Air Accident Insurance cover of ₹1 crore.

If you’re looking for a card with travel-related insurance benefits, you might want to check out the Axis Indian Oil Credit Card for additional perks.

Fuel Surcharge Waiver

Enjoy a 1% fuel surcharge waiver on transactions ranging from ₹400 to ₹4,000, with a maximum benefit of ₹400 per month.

Fees and Charges

| Fee Type | Detail |

|---|---|

| Joining Fee | Nil |

| Annual Fee | Nil |

| Finance Charges | 3.6% per month | 52.86% per annum |

| Late Payment Fee | Varies from ₹100 to ₹1,000 depending on the amount due. |

For more details on cards with fuel benefits, explore the SBI BPCL Credit Card, which is specifically tailored for fuel transactions.

Eligibility and Documentation

Both Resident and Non-Resident Indians can apply for this card if they meet the following criteria:

| Criteria | Details |

|---|---|

| Minimum Age | 18-70 years |

| Occupation | Salaried or Self-Employed |

| Minimum Income | ₹5 lakh per annum or ₹42,000 gross salary |

For individuals with a lower income requirement, you may want to explore the IDFC First WOW Credit Card, which offers benefits with a ₹3 lakh income eligibility.

Required Documents

You’ll need to provide standard identification, proof of income, and address verification. For a detailed list, you can refer to the official documentation guidelines.

Should You Get This Card?

The LIC Axis Bank Platinum Credit Card is an excellent choice for anyone who frequently makes LIC premium payments. Its rewards structure is basic but beneficial if you prioritize LIC-related expenses. However, if you require a more versatile rewards card, you might explore other options with broader reward redemption capabilities, like the IDFC First Power Credit Card.

Comparison with Other Cards

The LIC Axis Bank Platinum Credit Card is a basic variant when compared to the Titanium and Signature versions:

| Particulars | LIC Titanium Credit Card | LIC Platinum Credit Card | LIC Signature Credit Card |

|---|---|---|---|

| Joining Fee | Nil | Nil | Nil |

| Annual Fee | Nil | Nil | Nil |

| Minimum Income | ₹3 lakh per annum | ₹5 lakh per annum | ₹15 lakh per annum |

| Rewards on LIC Payments | 2 points per ₹100 | 2 points per ₹100 | 2 points per ₹100 |

| Rewards on Other Transactions | 1 point per ₹100 | 1 point per ₹100 | 1 point per ₹100 |

For those seeking cashback options on retail spending, the SBI Cashback Credit Card might be a more suitable option.

Conclusion

Weighing all the features and benefits, the LIC Axis Bank Platinum Credit Card is particularly advantageous for those with significant LIC payments but may not be the best general-purpose rewards card. Consider your financial habits and needs before making a decision.If you’re looking for broader rewards and shopping benefits, you could consider the Flipkart Axis Bank Credit Card, which offers substantial rewards on e-commerce purchases.