SBI Simply SAVE CREDIT CARD: Features, Benefits, Review

SBI SimplySAVE is a great entry-level credit card that is perfect for beginners. With a low annual fee and attractive reward points on daily expenses like groceries and dining, it’s a practical choice for many.

Best Features

What makes the SBI SimplySAVE Credit Card stand out are its features:

- 10X reward points on dining, groceries, movies, and departmental store purchases.

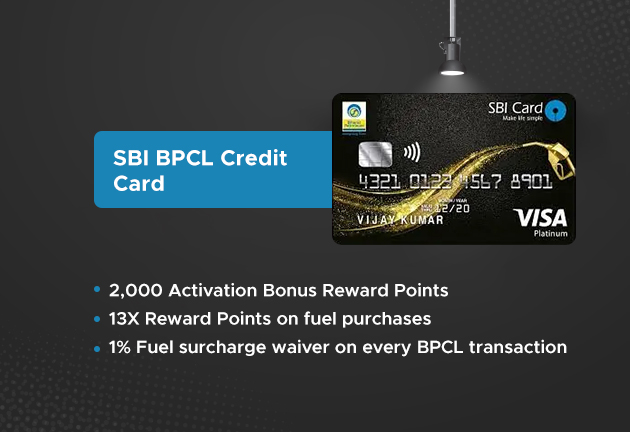

- 1% fuel surcharge waiver on transactions between ₹500 to ₹3,000.If you’re into fuel benefits, check out our SBI BPCL Credit Card Review.

- 2,000 bonus reward points as a welcome benefit on spending ₹2,000 within 60 days.

Fees & Charges

Here’s a quick overview of the fees and charges:

| Type of Fee/Charge | Amount |

|---|---|

| Joining Fee | ₹499 |

| Annual Fee | ₹499 (Reversed on spending ₹1 lakh in a year) |

| Finance Charges | 3.50% per month |

| Late Payment Fee | Up to ₹1,300 based on the statement balance |

If you’re looking for a card with similar annual fee reversals and more rewards, you might also consider the SBI Cashback Credit Card or the Axis Neo Credit Card.

Benefits

Utilize the SBI SimplySAVE Credit Card to its fullest by understanding these benefits:

- Reward points that can be redeemed for vouchers or merchandise.For a comparison of different rewards programs, check out Flipkart Axis Bank Credit Card Review.

- Special offers on dining, movies, and fuel. For additional fuel savings, check out Axis Indian Oil Credit Card Review.

- Easy reward points redemption via SBI’s customer portal.

Annual Fee Waiver

If you spend ₹1 lakh in a year, your annual fee of ₹499 will be reversed, making this card highly economical for regular users. For more economical credit cards, check out the IDFC First WOW Credit Card, which offers great cashback options.

Eligibility & Documentation

Interested in getting an SBI SimplySAVE Credit Card? Here are the required criteria:

- Age: 21 to 70 years

- Occupation: Salaried or Self-employed

- Documents: Standard KYC documents (Click here for the detailed list)

- Serviceable Cities: List of eligible cities (Click here for more details)

Conclusion

To sum up, the SBI SimplySAVE Credit Card is a solid choice for beginners and those looking for an economical card with beneficial rewards on everyday spending. If you fit the criteria, it’s definitely worth considering this card for your regular transactions.

For more credit card comparisons, you can also check out our reviews of the IDFC First Power Credit Card and the Amex MRCC Credit Card.