IDFC First Bank Wealth Debit Card Review: My Hands-On Experience

Is the IDFC First Bank Wealth Debit Card worth it? Based on my experience, it’s a mixed bag of perks and drawbacks that cater specifically to high-net-worth individuals.

Eligibility Criteria

To be eligible for the IDFC First Wealth Debit Card, you need to join the IDFC First Wealth Program by maintaining a minimum Net Relationship Value (NRV) of ₹10 lakhs. This can include a combination of savings account balances, Fixed Deposits (FDs), and investments. Note that criteria might slightly vary based on location and time. Sometimes, old loyal customers may receive this program at a lower NRV.

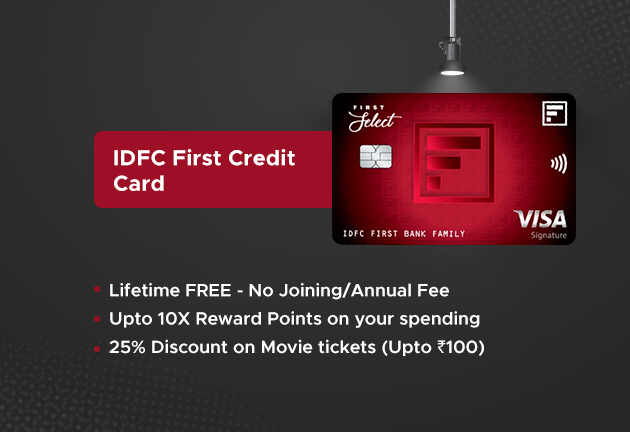

If you’re also looking for credit cards with specific eligibility criteria, you might want to check out this review on IDFC First WOW Credit Card for a comparison of benefits.

Features & Benefits

This debit card packs a punch with a plethora of features and benefits.

| Feature | Details |

|---|---|

| ATM Withdrawal Limit | ₹7 Lakhs per day |

| Purchase Limit | ₹12 Lakhs per day |

| Domestic Airport Lounge Access | 3 visits per quarter + 3 companions, at ₹2 per visit |

| International Airport Lounge Access | 2 visits per quarter, $32 charge reversed in 10 days |

Other notable benefits include:

- Complimentary ID Sentry membership for ID theft protection

- Air Accident Insurance cover of ₹2.5 Crores

- Personal Accident cover of ₹1 Crore

- Lost Card Liability cover of ₹12 Lakhs

- Purchase Protection cover of ₹1 Lakh

- Complimentary Road Side Assistance (RSA)

- 1 complimentary golf access per month at partner clubs

- Up to 10X accelerated reward points on debit card (currently in Beta testing)

- Visa Infinite privileges

If you want a high-end alternative credit card with excellent airport lounge access and rewards, the Axis Magnus Card could be worth considering.

Welcome Kit Unboxing

Initially, the onboarding kit came in a premium faux leather folder. However, this has now been downgraded to a simple envelope, which doesn’t quite justify the premium status.

Drawbacks

Despite its valuable perks, the card has some notable drawbacks:

- 2% international transaction markup fee

- No EazyDiner offers

- No significant movie benefits except for Visa Infinite offers

- Delayed reward points under Beta testing

For those looking for better international transaction benefits, the ICICI Emeralde Credit Card might be a good alternative.

Application Experience

Once you meet the NRV requirement, the onboarding process begins but can take some time. The Visa Platinum debit card is delivered within a week, whereas the Wealth debit card can take up to 30 days as your relationship manager processes the upgrade.

Bottomline

The IDFC First Wealth Debit Card aims to compete with other high-end banking programs like HDFC Imperia and Axis Burgundy. While it offers robust features such as RSA and extensive lounge access, it lacks some critical value-added services like NIL markup fees and immediate reward points, which hinders its overall appeal.

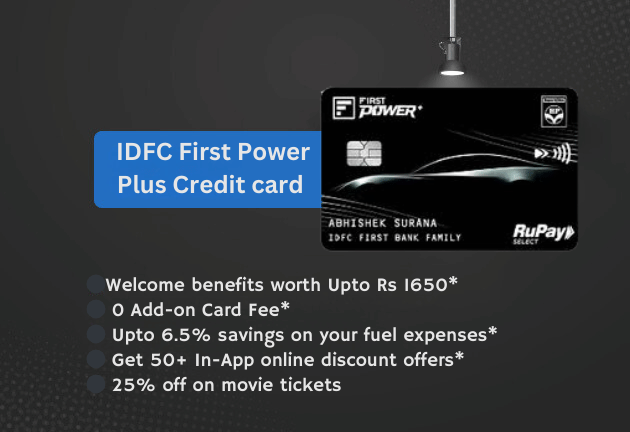

If the reward points system improves post-Beta testing, this card has the potential to become one of the most rewarding debit cards available.For an in-depth comparison of other cards with similar features, check out the review of the IDFC First Power Credit Card.