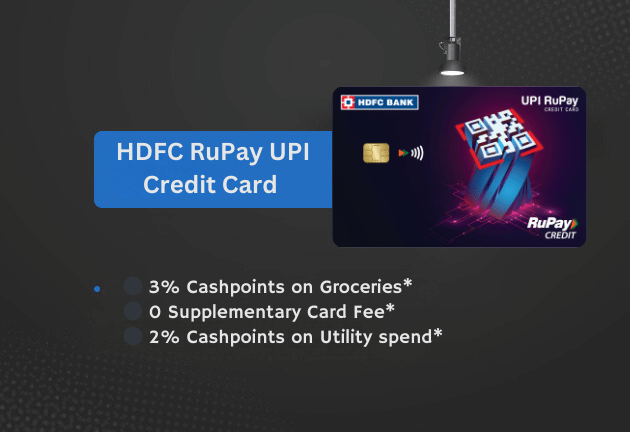

HDFC RuPay UPI Credit Card: Detailed Review and Benefits

The HDFC RuPay UPI Credit Card offers a seamless way to make UPI payments while earning rewards. It is a virtual card that you can link to your UPI ID, facilitating both regular transactions and UPI payments.

Features and Benefits

The HDFC RuPay UPI Credit Card stands out for its blend of convenience and rewards. Here are some of its key features:

UPI Benefits

Cardholders earn CashPoints on both regular and UPI transactions, making it versatile for various spending categories.For those interested in exploring other credit cards with UPI or similar features, you can check out the IDFC First Bank Credit Card or the Axis Indian Oil Credit Card.

Cashback Benefits

Enjoy up to 3% CashPoints on groceries, supermarket spending, dining, and PayZapp transactions. Here’s how it breaks down:

| Category | CashPoints |

|---|---|

| PayZapp, Groceries, Dining | 3% (up to 500 points/month) |

| Utility Spends | 2% (up to 500 points/month) |

| Other Purchases | 1% (up to 500 points/month) |

Note: 1 CashPoint equals Rs. 0.25. If you’re looking for more cashback cards, take a look at the SBI Cashback Credit Card Review.

Welcome Benefit

New cardholders receive a Rs. 250 voucher upon paying the joining fee and activating the card within 37 days.Other cards offering similar welcome benefits include the Axis Bank My Zone Credit Card and the IDFC First Wow Credit Card.

Other Amazing Offers

- Leverage revolving credit facilities at nominal interest rates

- Get liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

- Earn rewards on all spends that can be redeemed for exciting gifts, vouchers or free flight tickets

- CashPoints earned on HDFC Bank UPI RuPay Credit Card can be redeemed against the statement balance at the rate of 1 CashPoint = Rs 0.25 and can be done via Net Banking login or physical redemption form

If you’re comparing with other cards that offer redemption benefits, take a look at the Flipkart Axis Bank Credit Card Review.

Virtual Card

This card is entirely virtual, available via the MyCards platform or PayZapp app, ensuring convenience and security.Similar virtual features can be found in the Airtel Axis Bank Credit Card.

Fee Waiver

Spend Rs. 25,000 or more in a year to get the Rs. 99 renewal fee waived.

Fees and Charges

The HDFC RuPay UPI Credit Card comes with the following fees and charges:

| Fee Type | Details |

|---|---|

| Joining Fee | Rs. 99 |

| Renewal Fee | Rs. 99 (waived if spending Rs. 25,000+ in the previous year) |

| Supplementary Card Fee | Nil |

| Finance Charges | 3.75% per month (45% annually) |

| Late Payment Fee | Up to Rs. 100: Nil Rs. 101 to Rs. 500: Rs. 100 Rs. 501 to Rs. 1,000: Rs. 500 Rs. 1,001 to Rs. 5,000: Rs. 600 Rs. 5,001 to Rs. 10,000: Rs. 750 Rs. 10,001 to Rs. 25,000: Rs. 900 Rs. 25,001 to Rs. 50,000: Rs. 1,100 More than Rs. 50,000: Rs. 1,300 |

If you’re looking for alternatives with low fees, the Amex MRCC Credit Card and the ICICI Emeralde Credit Card might be worth exploring.

Documents Needed

- Address Proof – Aadhaar, Passport, Latest utility bills

- ID proof – PAN, Voter ID, Passport

- Income proof – Bank Statement, Salary Slips

Eligibility Criteria

- Required Age: 21-65 years

- Employment status: Salaried or Self-Employed

- Minimum Income: Rs 20,000 per month (Salaried)

- Minimum Income: Rs 50,000 per month (Self-Employed)

- Credit score: 700+

- You should be citizen of India or a Non-Resident Indian

For eligibility and other detailed benefits, you can also refer to the IDFC First Power Credit Card Review.

Should You Apply?

If you prefer earning rewards on your UPI transactions and are looking for a low-annual-fee card, the HDFC RuPay UPI Credit Card is an excellent option. With up to 3% cashback on selected categories and various other benefits, it’s perfect for users seeking a combination of convenience and rewards. However, do keep in mind that the cashback points are capped at 500 points per month per category.

For comparison with other low-annual-fee cards, check out the AU Altura Credit Card Review.

FAQs

Can I link this card to other UPI apps?

Yes, you can link it to any UPI app by following these steps:

- Set up the credit card PIN by calling HDFC’s IVR number (1860 266 0333).

- Download and log in to your preferred UPI app.

- Register your HDFC UPI RuPay card using the credit card PIN.

Is there a limit to the number of UPI transactions?

No, there is no limit to the number of UPI transactions, but the transaction amounts may have certain individual limitations.If you’re curious about other card features with transaction limits, the Axis Neo Credit Card has similar details.

Why can’t I make UPI payments after my card is renewed?

Once your HDFC UPI credit card is renewed or replaced, you need to re-register on the UPI apps with updated card details.

Is there a minimum transaction amount to earn CashPoints?

Yes, transactions must be Rs. 100 or above to earn CashPoints. Note that SmartBuy platform spends do not earn any CashPoints.