Swiggy HDFC Credit Card: A Comprehensive Review for 2024

The Swiggy HDFC Credit Card is a valuable asset for frequent Swiggy users, offering 10% cashback on Swiggy services including food delivery, Instamart, Dine Out, and Genie. Additionally, it provides 5% cashback on other online purchases and 1% cashback on offline transactions, all for an annual fee of Rs 500.

Key Features and Benefits

The Swiggy HDFC Credit Card stands out for several reasons. Let’s dive into its key features:

Generous Cashback Offers

- 10% cashback on Swiggy platforms

- 5% cashback on online purchases

- 1% cashback on offline spends

You might also be interested in other cards offering great cashback on online platforms like the Flipkart Axis Bank Credit Card or SBI Cashback Credit Card, which also cater to online shoppers.

Additional Perks

- Complimentary 3-month Swiggy One membership upon activation

- Renewal fee waiver for annual spends over Rs 2 lakh

- Golf benefits including free green fees and lessons

For those who seek additional perks like airport lounge access or fuel benefits, you may want to explore the Axis Indian Oil Credit Card or IDFC First Wow Credit Card.

Exclusions

Some spending categories don’t earn cashback, such as fuel, rent, EMIs, jewelry, wallet transactions, government-related transactions, and Swiggy-specific exclusions like Swiggy Minis and liquor.

Cashback Redemption

The cashback earned is now directly credited against the outstanding card dues for the next month, which is a significant improvement from the previous Swiggy Money redemption system. This makes it more flexible and beneficial for users who might want to apply their cashback towards a broader range of expenses.You can compare this with the cashback redemption of the HSBC Live Credit Card, which offers a different approach to rewards.

OTHER AMAZING OFFERS

Upto 50 days of interest-free period from the date of purchase

Leverage revolving credit facilities at nominal interest rates

Zero lost card liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

Annual fee waiver on spending Rs 2 lakh annually

Comparison With Other Cards

| Parameters | HDFC Swiggy | ICICI Amazon Pay | Axis Flipkart |

|---|---|---|---|

| Annual Fee | Rs. 500 | Nil | Rs. 500 |

| Fee Waiver | On Rs. 2 lakh annual spends | NA | On Rs. 2 lakh annual spends |

| Welcome Benefits | 3-month Swiggy One membership | NA | Save up to Rs. 1,100 on Flipkart, Myntra, and Swiggy |

| Base Cashback Rate | 1% up to Rs. 500 p.m. | 1% | 1.5% |

| Accelerated Cashback | 10% up to Rs. 1,500 p.m. on Swiggy, 5% up to Rs. 1,500 p.m. on online spends | 5% on Amazon by Prime members | 5% on Flipkart |

| Other Benefits | NA | Up to 15% off on dining at partner restaurants | 4 domestic airport lounge visits per year, up to 20% off at partner restaurants |

| Cashback Redemption | As statement credit | As Amazon Pay balance | As statement credit |

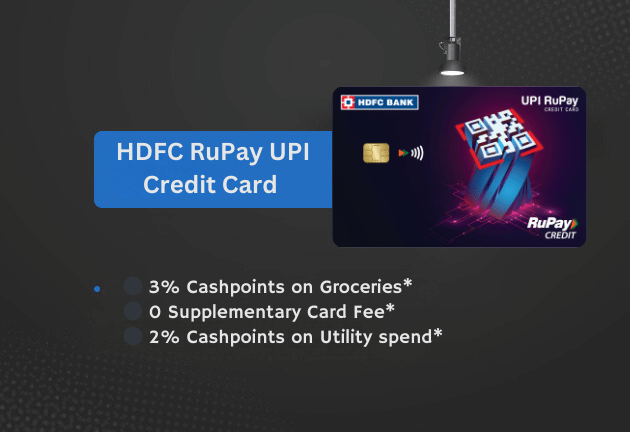

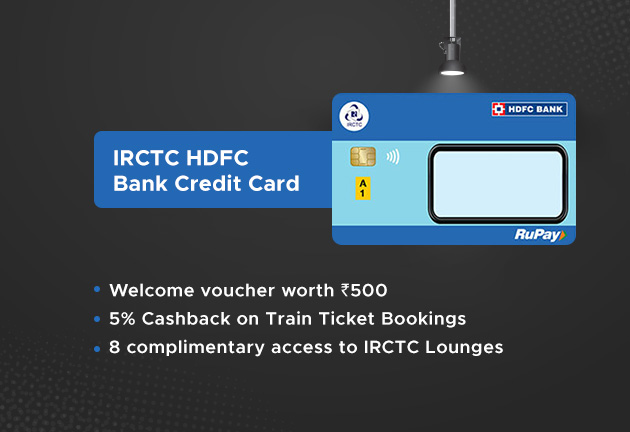

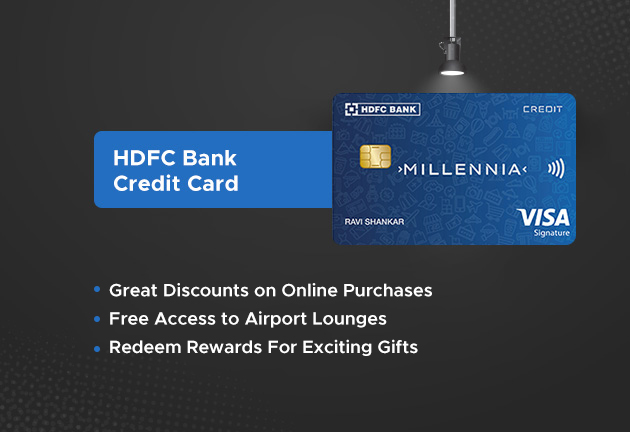

You can check out the detailed reviews of other cards like Axis Magnus Card or the HDFC Bank Credit Card for comparison.

Is This Card for You?

If you regularly use Swiggy services or spend significantly on online shopping, the Swiggy HDFC Credit Card is a great choice. However, if you don’t frequent these platforms, you might want to explore other cashback cards that could better suit your spending habits, such as the Tata Neu HDFC Bank Credit Card or the ICICI Emeralde Credit Card.

Considering the features and benefits this card offers, it certainly provides good value for its annual fee, especially for dedicated Swiggy users. And yes, the complimentary golf benefits are a delightful bonus!