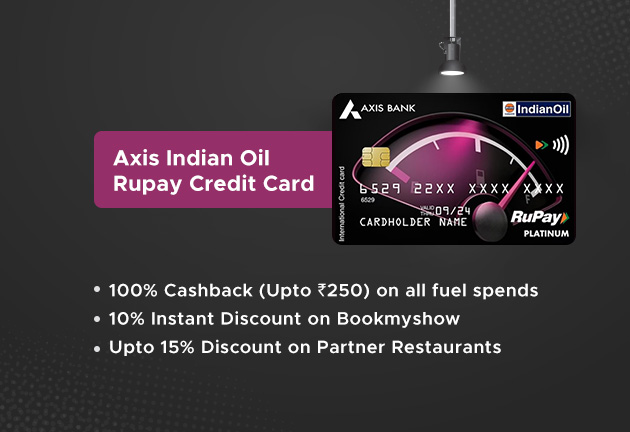

Axis Indian Oil Credit Card Review: Key Features & Benefits

Looking for a way to save on fuel expenses? The Axis Indian Oil Credit Card might be the answer you’re searching for. This card offers numerous benefits, including accelerated reward points on fuel and decent earnings on online shopping.

Why Choose Axis Indian Oil Credit Card?

The Indian Oil Axis Bank Credit Card is specifically designed for individuals who frequently spend on fuel. By using this card, you can maximize your savings through reward points that convert to monetary value. Let’s dive into some standout features.

Key Highlights

This card offers several attractive benefits:

- 4% value-back on fuel transactions at IndianOil outlets.

- Welcome benefits in the form of EDGE reward points.

- Discounts on dining and movie bookings.

- Annual fee waiver on reaching specified spending thresholds.

Fees & Charges

| Type of Fee/ Charge | Amount |

|---|---|

| Joining Fee | Rs. 500 |

| Annual Fee | Rs. 500 (waived on spending Rs. 3.5 lakh per year) |

| Finance Charges | 3.4% p.m. (49.36% p.a.) |

| Late Payment Fee | Rs. 500 to Rs. 1,200 based on outstanding amount |

Additional Benefits

- 1,250 EDGE reward points as a welcome benefit for transactions made within the first 30 days.

- 1% fuel surcharge waiver on fuel spends worth Rs. 400 to Rs. 4,000.

- 10% discount on movie tickets via BookMyShow.

- Up to 15% discount on dining via partner restaurants.

Eligibility & Documentation

- Age Requirement: 18 to 70 years

- Occupation: Salaried or Self-employed

- Documents: Identity and address proof, income proof

Is This Card Right for You?

The Indian Oil Axis Bank Credit Card is highly beneficial for those who have regular fuel expenses. If your monthly fuel spends hover between Rs. 3,000 to Rs. 5,000, this card can offer significant savings. Additionally, if you participate in online shopping, dining out, and movie-watching, this card adds even more value to your wallet.

However, if your expenditure spans various categories beyond fuel, you might want to explore other top credit cards available in the market.

Competing Fuel Credit Cards

| Card Name | Joining Fee | Annual Fee | Fuel Rewards |

|---|---|---|---|

| IDFC FIRST Power+ Credit Card | ₹499 | ₹499 | 5% savings at HPCL |

| IndianOil HDFC Credit Card | ₹500 | ₹500 | 5% fuel points at IndianOil outlets |

| BPCL SBI Card | ₹499 | ₹499 | Up to 4.25% back at BPCL |

| ICICI Bank HPCL Coral Credit Card | ₹199 | ₹199 | Up to 3.5% savings at HPCL |

In summary, the Indian Oil Axis Bank Credit Card is one of the top choices for fuel-related expenses. If aligned with your spending habits, it can provide notable financial benefits and added perks.