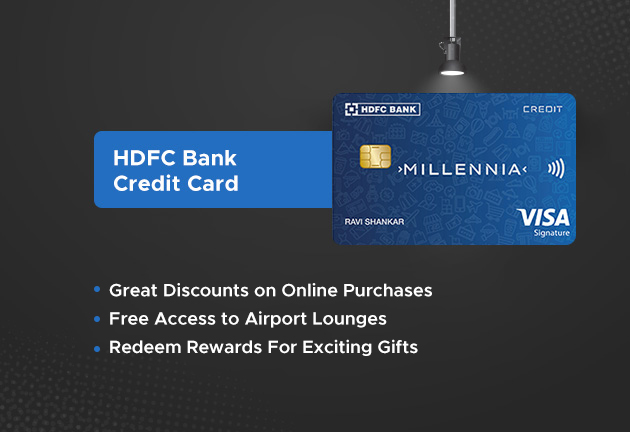

HDFC Bank Credit Card Review: Features and Benefits

HDFC Bank Credit Cards offer a blend of usability and convenience, making them a popular choice for many.

Comprehensive Card Management

The HDFC MyCards app serves as a one-stop solution for managing your credit cards. You can check transactions, set card limits, and redeem rewards points all in one place, eliminating the need to go through traditional net banking.If you’re also interested in a card offering strong management features, check out our review of the Tata Neu HDFC Bank Credit Card.

User Experience

HDFC Bank has prioritized a simple and smooth user experience with the MyCards app. From easy logins to quick access to various services, the app is designed to offer maximum convenience without the hassle of remembering multiple passwords.You may also want to explore the user experience offered by IDFC First WOW Credit Card for comparison.

Customer Reviews

Users have lauded the app’s user-friendliness, transparency, and ease of navigation. Here are a few testimonials:

| User | Review | Location |

|---|---|---|

| Malay Biswas | Extremely user-friendly; transparency is great | Madhya Pradesh |

| Navya Satyala | One-stop solution for credit card management | Maharashtra |

| Sanyam Sudan | Simple and smooth user experience | Delhi |

| Md. Kaifi | Much-needed initiative, very user-friendly | Jharkhand |

Secure and Instant UPI Transfers

HDFC Bank also excels in UPI funds transfer, offering instant and secure mobile money transfers using just a UPI ID. This added functionality boosts the overall utility of their credit cards by allowing for quick transactions at your fingertips.For a similar experience with UPI functionality, you may want to consider the SBI Cashback Credit Card.

Eligiblity Criteria

- Age group: 21-65 years

- Employment status: Salaried or Self-Employed

- Minimum Income: Rs 20,000 per month (Salaried)

- Minimum Income: Rs 50,000 per month (Self-Employed)

- Credit Score: 700+

- You should be citizen of India or a Non-Resident Indian

For more details on similar eligibility criteria, you can explore the ICICI Emeralde Credit Card.

Fees And Charges

| Joining Fees: | Starting at Rs 500 + GST |

| Annual Fees: | Starting at Rs 500 + GST |

For those looking for a lower fee structure, the Axis Neo Credit Card may be an interesting option to consider.

Conclusion

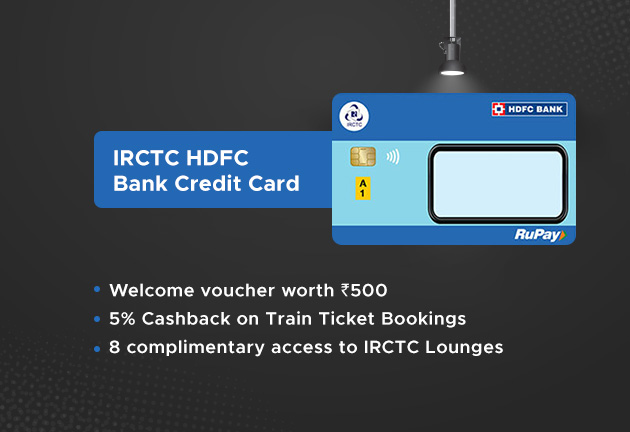

In summary, HDFC Bank’s credit cards and their MyCards app offer a seamless and efficient experience. Whether you need to manage your cards, check transactions, or perform UPI transfers, HDFC Bank has simplified the process substantially. So, why wait? Consider applying for an HDFC Bank credit card today and experience these benefits for yourself!If you’re still exploring options, you might want to read our comprehensive review of the IRCTC HDFC Bank Credit Card.